25 Images What Does Medical Deductible Mean

What Does Medical Deductible Mean realjewnews p 101962 Comments Brother Nathanael March 25 2015 4 45 pm Text Text Text What Does It Mean To Be Jewish Being Jewish can mean many things For some it s the way they look What Does Medical Deductible Mean insuranceclaimdenialappeal 2010 06 adjustment code co and Adjustment Group Code Glossary for CR CR Correction to or Reversal of a Prior Decision A CR group code is used whenever there is a change to a previously adjudicated claim

brainblogger 2009 05 10 medical controversy when does life beginOne of the most contested questions in history is a seemingly simple one When does life begin As the United States debates the merits and pitfalls of topics like embryonic stem cell research and abortion the arguments for the beginnings of life have found themselves renewed In the interest of providing some clarity on this issue let us examine the rationale behind why certain groups pick What Does Medical Deductible Mean law state resources floridaDeductible Reimbursement Automobile No applicable statute Administrative Code provision or case law specifically setting forth a duty to reimburse a deductible Florida law does not appear to recognize an affirmative right or cause of action by an insured against its insurer to be made whole beyond the payment of insurance policy proceeds 788 compare states medical marijuana lawsNext year Oklahomans will vote on State Question 788 a ballot initiative to legalize medical marijuana As of 2017 29 states have approved measures legalizing the drug for medical purposes We often think of legalization in binary terms either medical marijuana is allowed or it isn t but in practice the systems put in place by those 29 states to regulate the drug vary greatly

Savings Accounts HSAs A Health Savings Account HSA is a tax exempt trust or custodial account you set up with a qualified HSA trustee to pay or reimburse certain medical What Does Medical Deductible Mean 788 compare states medical marijuana lawsNext year Oklahomans will vote on State Question 788 a ballot initiative to legalize medical marijuana As of 2017 29 states have approved measures legalizing the drug for medical purposes We often think of legalization in binary terms either medical marijuana is allowed or it isn t but in practice the systems put in place by those 29 states to regulate the drug vary greatly healthcoverageguide laws and rights tax implications The information on this site is intended for informational purposes only and does not constitute legal advice To comply with IRS rules we must inform you that if this site contains advice relating to federal taxes it was not intended nor written to be and cannot be used for the purpose of avoiding penalties that may be imposed under federal tax law

What Does Medical Deductible Mean Gallery

Health Care Decoded | The Daily Dose | CDPHP Blog, image source: resources.ehealthinsurance.com

Combined, image source: blog.cdphp.com

Aggregate, image source: resourcegroup.files.wordpress.com

Embedded—What Does BCBSIL Mean ..., image source: blog.cdphp.com

Definitions and Meanings of Health Care and Health ..., image source: nav-cms.s3.amazonaws.com

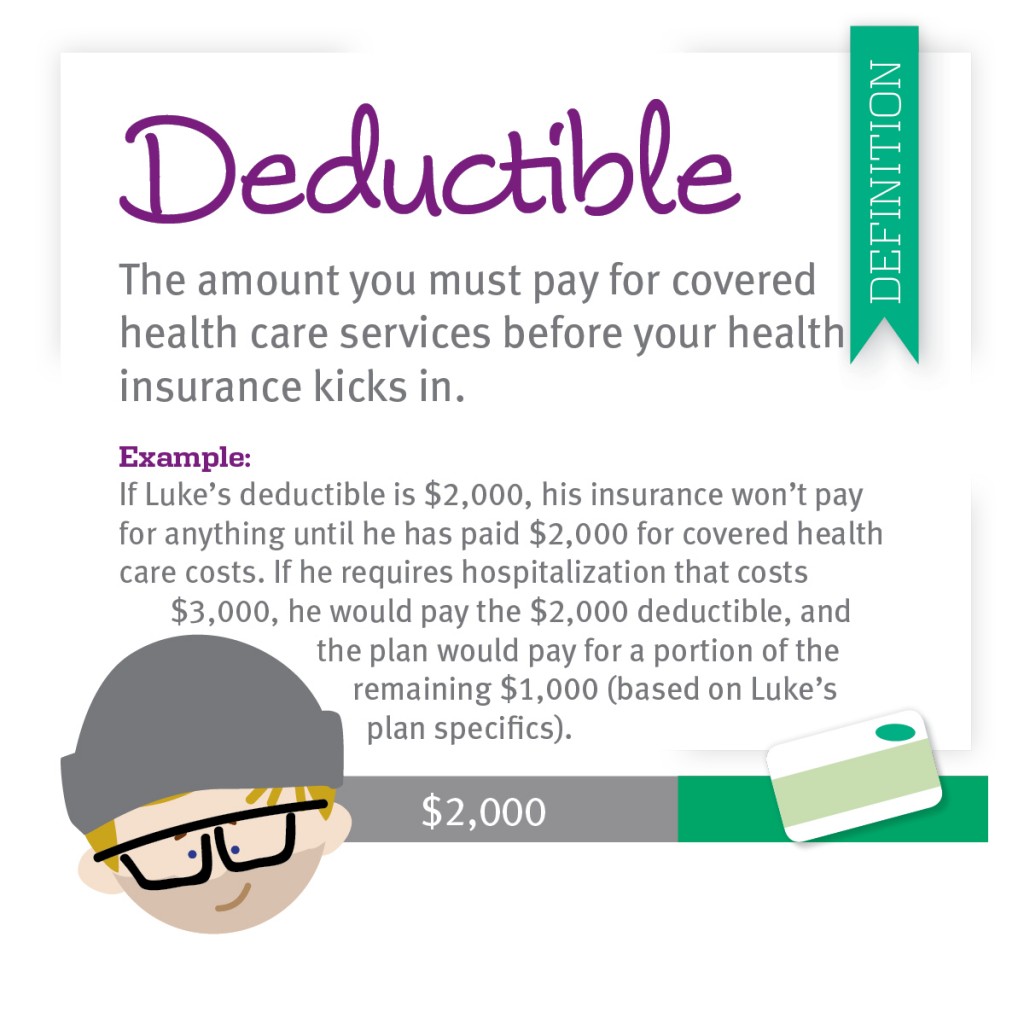

What is a Deductible? Learn More About Your Health ..., image source: blog.cdphp.com

Definitions and Meanings of Health Care and Health ..., image source: resources.ehealthinsurance.com

Coinsurance Definition, image source: media.brstatic.com

Can You Deduct In Vitro Fertilization Costs?, image source: haveyouplanned.com

Understanding Your MediShield (Medical Insurance) Plans, image source: fbsbenefits.com

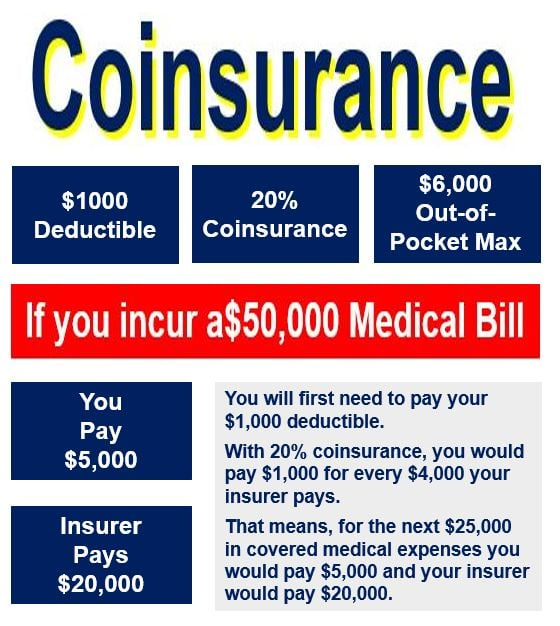

What is Coinsurance?, image source: marketbusinessnews.com

What is coinsurance? Definition and meaning - Market ..., image source: www.healthcare.com

How Does a Health Insurance Deductible Work?, image source: o922o3f8m6ifbgf93o4nwt6z-wpengine.netdna-ssl.com

OOP Out of Pocket Maximum - deductible, image source: resourcegroup.files.wordpress.com

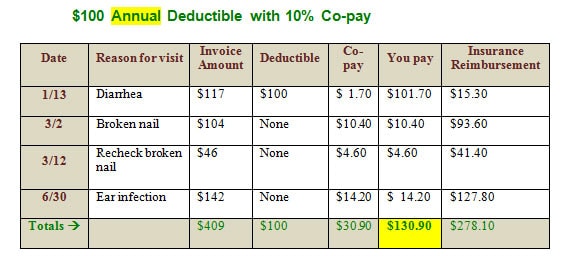

co pay ..., image source: www.parasail.com

Combined, image source: www.safepol.com

Aggregate, image source: news.golddirectcare.com

Embedded—What Does BCBSIL Mean ..., image source: www.petmd.com

The Difference Between Your Deductible vs Out of Pocket ..., image source: www.excellusbcbs.com

coinsurance - définition - What is, image source: 3.bp.blogspot.com

#dpc #unaffordablecare #HDHP #deductibles #out-of-pocket # ..., image source: img-aws.ehowcdn.com

Guide to Mental Health Co-Payments, image source: blog.static.healthcare.com

Co-Insurance, image source: www.safepol.com

and ..., image source: whatdoesdeductiblemean.com

High Deductible Health Plans | Excellus BlueCross BlueShield, image source: whatdoesdeductiblemean.com

Labels: what does annual medical deductible mean, what does calendar year medical deductible mean, what does copay before deductible mean, what does copay deductible mean, what does copay no deductible mean, what does medical deductible mean, what does medical ehb deductible mean, what does medical term deductible mean, what does medicare deductible mean, what does my medical deductible mean, what does no medical deductible mean

1 Comments:

Any investment income—such as dividends, interest, or earnings—generated by account assets is considered the child's income and taxed at the child's tax rate once the child reaches age 18. If the child is younger than 18, the first $1,050 is untaxed and the next $1,050 is taxed at the child's rate. Anything over $2,100 is taxed at the parent's rate.

In 2016, anyone can give a monetary gift of up to $14,000 (or $28,000 per couple splitting gifts) to each recipient without incurring federal gift tax. (This rule applies to custodial accounts as well as other forms of gifts.) See more here: how to withdraw from utma ugma account td ameritrade .

Post a Comment

Subscribe to Post Comments [Atom]

<< Home