25 Best Are Health Insurance Premiums Deductible

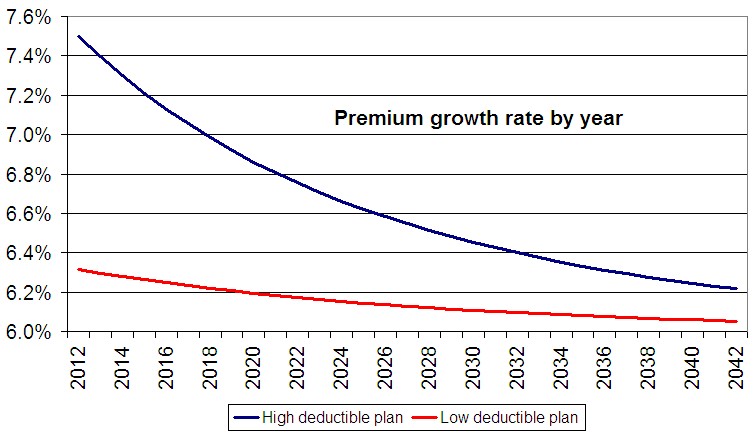

Are Health Insurance Premiums Deductible 09 2014 High deductible plans High deductible health plans also referred to as consumer directed plans are plans whose deductibles surpass a limit Are Health Insurance Premiums Deductible deductible health planIn the United States a high deductible health plan HDHP is a health insurance plan with lower premiums and higher deductibles than a traditional health plan Being covered by an HDHP is also a requirement for having a health savings account Some HDHP plans also offer additional wellness benefits provided before a deductible is paid

or low deductible If you re deciding between a low and a high deductible health plan HDHP there s more to consider than deductibles and monthly premiums Are Health Insurance Premiums Deductible affordablehealthinsuranceAffordableHealthInsurance is your one stop shop for health insurance information and affordable health insurance rates We work with top providers to get you the best deals you buy a high Look for HSA enabled plans Signing up for a high deductible health insurance policy means you may be eligible for a health savings account or HSA However not all high deductible plans are HSA

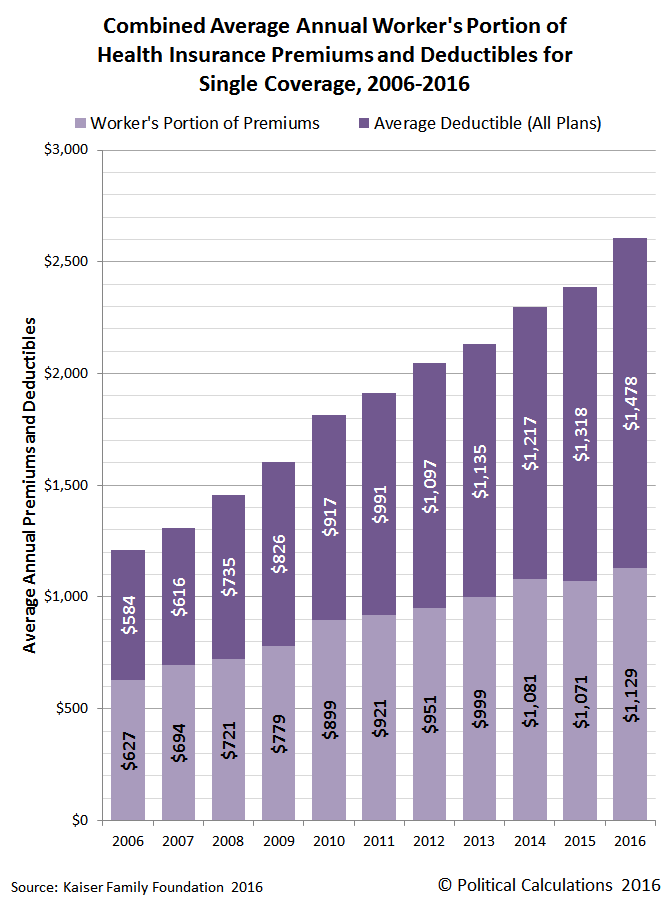

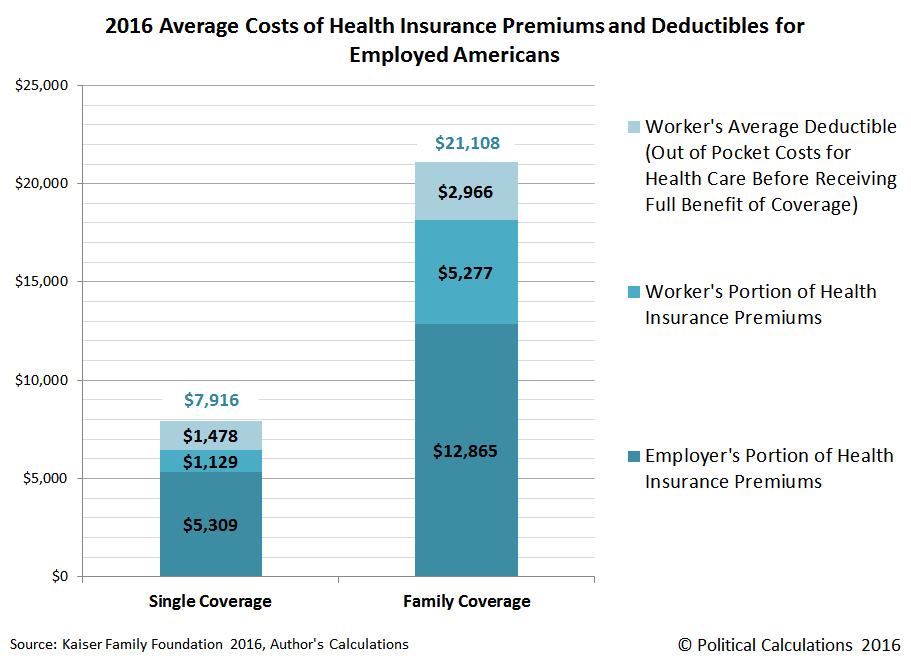

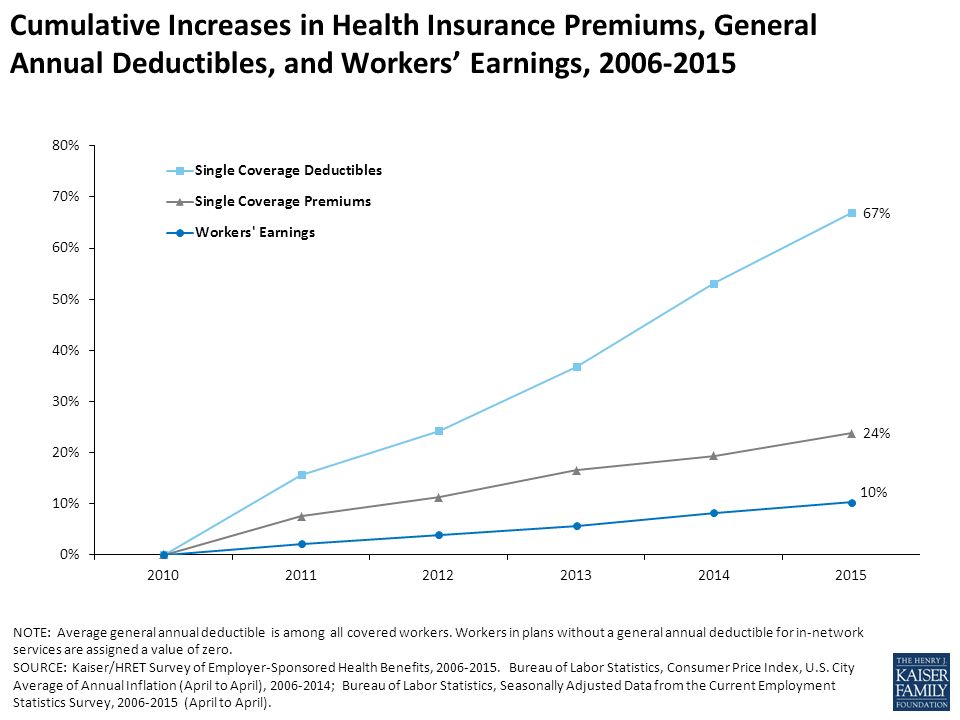

time money 4044394 average health deductible premiumWorkers now pay an average of 1 318 out of pocket before health insurance coverage begins to cover part of their bills up from 584 a decade ago according to a new report out from the Kaiser Are Health Insurance Premiums Deductible you buy a high Look for HSA enabled plans Signing up for a high deductible health insurance policy means you may be eligible for a health savings account or HSA However not all high deductible plans are HSA Insurance for Individuals and Family Individual and family health insurance plans can help cover expenses in the case of serious medical emergencies and help you and your family stay on top of preventative health care services

Are Health Insurance Premiums Deductible Gallery

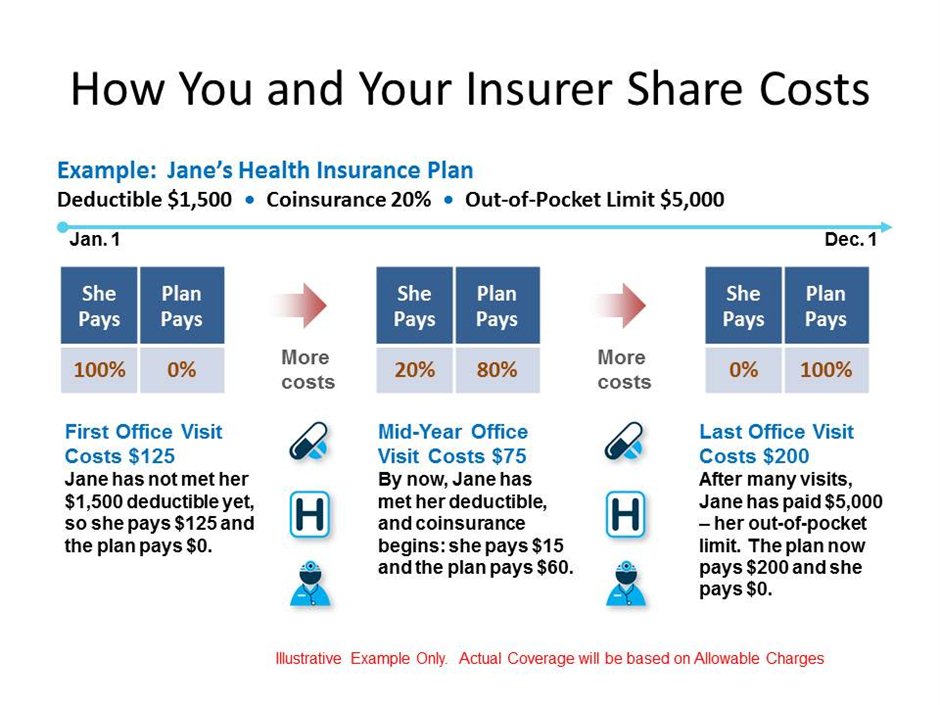

How a Deductible Works for Health Insurance, image source: blog.cdphp.com

Political Calculations: The Trends for Health Insurance ..., image source: resources.ehealthinsurance.com

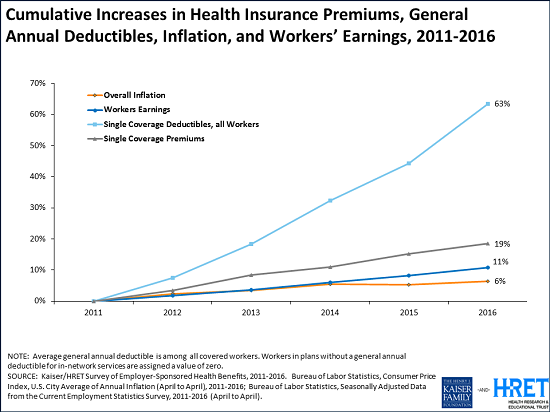

EHBS 2015 – Summary Of Findings – 8775 | The Henry J ..., image source: 3.bp.blogspot.com

HealthPopuli.com, image source: kaiserfamilyfoundation.files.wordpress.com

Decoding Doctor’s Office Deductibles | Blue Cross Blue ..., image source: healthpopuli.com

Average Annual Workplace Family Health Premiums Rise ..., image source: connect.bcbsok.com

Why my Health Insurance Premiums are Increasing 56% Next Year, image source: cdn2.hubspot.net

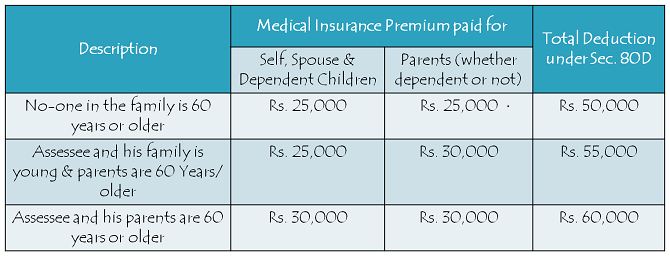

Deduction 80D: Tax Benefits on Health Insurance - Fiance Tool, image source: pc.net

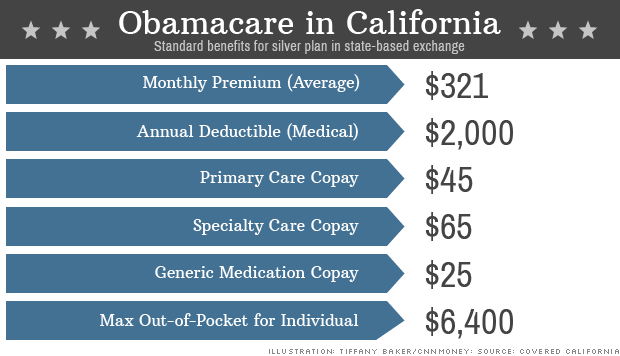

Obamacare: Is a $2, image source: i0.wp.com

000 deductible 'affordable?' - Jun. 13 ..., image source: i2.cdn.turner.com

Ironman Blog | The Cost Of Employer-Provided Health ..., image source: 2.bp.blogspot.com

Section 80D - Tax benefits - Health or Mediclaim insurance ..., image source: www.relakhs.com

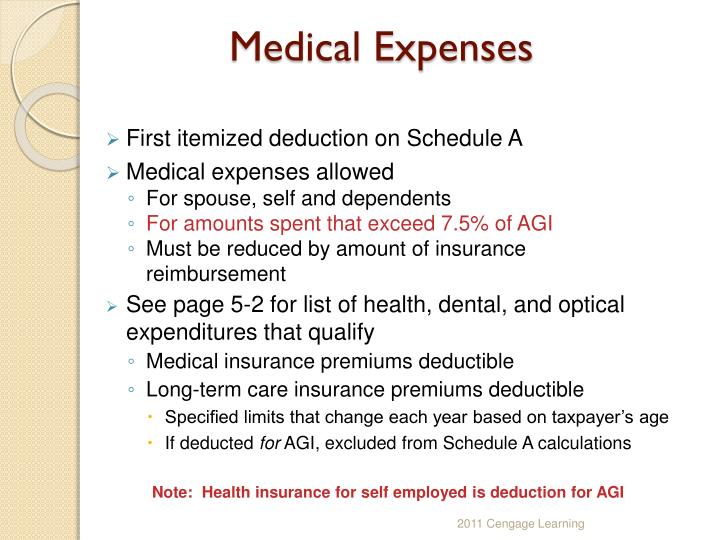

PPT - CHAPTER 5 Itemized Deductions & Other Incentives ..., image source: image1.slideserve.com

Flexible Health Savings Accounts: The Complete Guide to ..., image source: studentloanhero.com

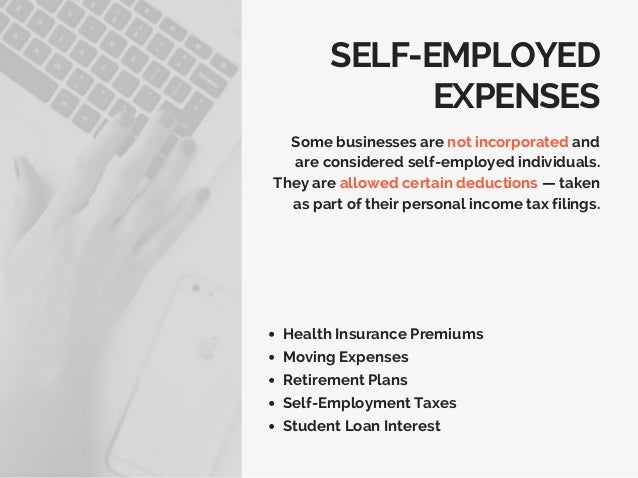

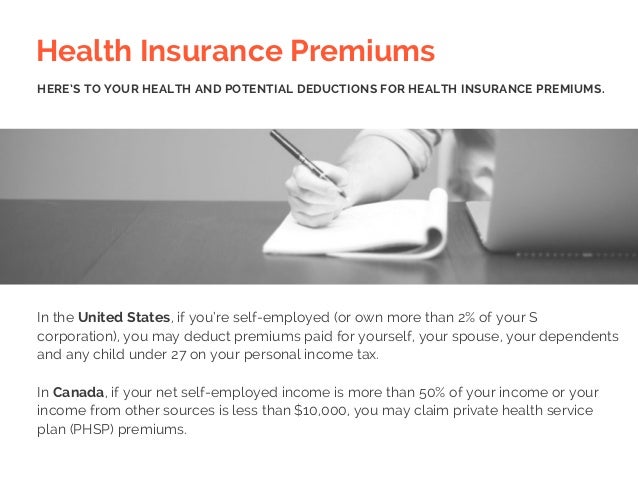

The Be-All, image source: image.slidesharecdn.com

End-All List of Small Business Tax Deductions, image source: theincidentaleconomist.com

High deductible health plans have a math problem | The ..., image source: www.westernhealth.com

HSA-Compatible High-Deductible Health Plans - www ..., image source: slideplayer.com

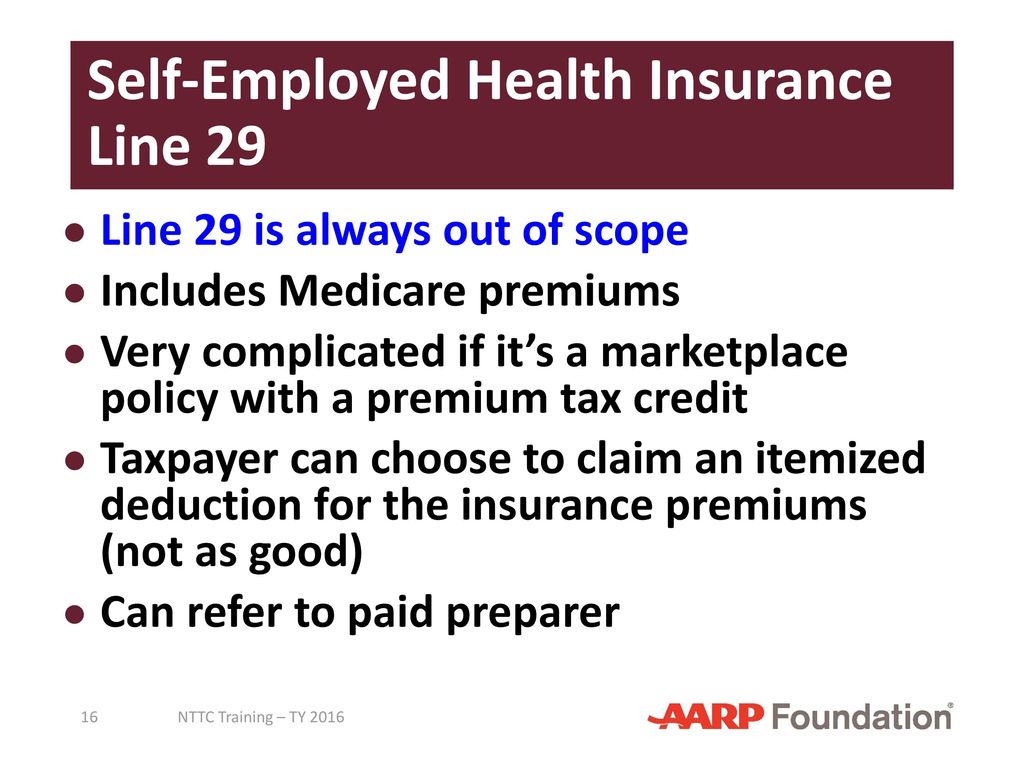

Adjustments to Income Pub 4491 – Lesson 18 Pub 4012 – Tab ..., image source: image.slidesharecdn.com

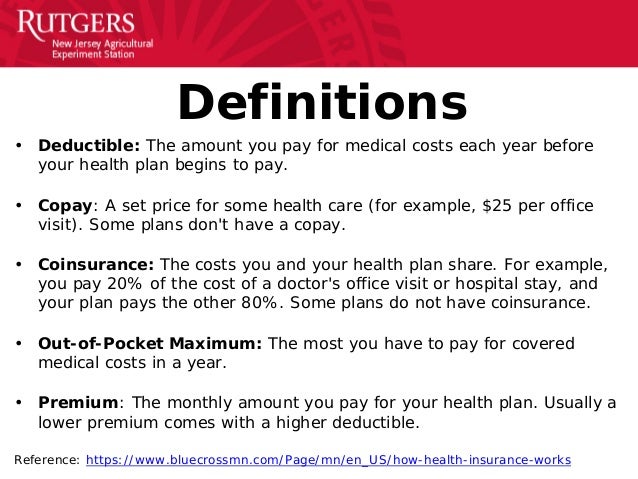

Health Insurance Terminology and Technology Tools-06-15, image source: slideplayer.com

Average Annual Premium Increases for Family Coverage ..., image source: upload.wikimedia.org

Insurance experts: prepare for substantial ACA/deductible ..., image source: findyourfreedom123.com

Understanding Your Health Insurance Terminology, image source: image.slidesharecdn.com

The Be-All, image source: www.onemint.com

End-All List of Small Business Tax Deductions, image source: www.mymoneyblog.com

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home