25 Unique Business Insurance Deductible

Business Insurance Deductible publication discusses common business expenses and explains what is and is not deductible The general rules for deducting business expenses are discussed in the opening chapter The chapters that follow cover specific expenses and list other publications and forms you may need Note Section Business Insurance Deductible taxes a deductible is the expenses subtracted from adjusted gross income for the determination of taxing liability

michaelpigottagencyAuto Auto insurance protects you against financial loss if you have an accident and provides property liability and medical coverage An auto insurance policy is comprised of six different kinds of coverage Business Insurance Deductible aaltci long term care insurance tax for business phplong term care insurance tax deductibility 2009 tax deduction long term care insurance long term care tax rules individual tax deduction limits business owners long term care insurance federal tax rules state tax limits how to buy long term care insurance you and your spouse jointly own and operate an unincorporated business and share in the profits and losses you are partners in a partnership whether or not you have a formal partnership agreement

insurance deductible rewards aspxSavings for safe driving Year after year you drive without getting into an accident you deserve to be rewarded for safe driving Get 100 off your deductible the day you sign up for Allstate Deductible Rewards Business Insurance Deductible you and your spouse jointly own and operate an unincorporated business and share in the profits and losses you are partners in a partnership whether or not you have a formal partnership agreement Insurance Home Insurance Business Insurance Life Health Insurance in Lutz Tampa Zephyrhills Wesley Chapel Brandon and Land O Lakes

Business Insurance Deductible Gallery

Guide to Mental Health Co-Payments, image source: i0.wp.com

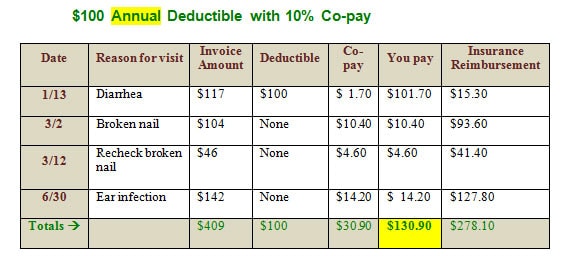

Co-Insurance, image source: www.petmd.com

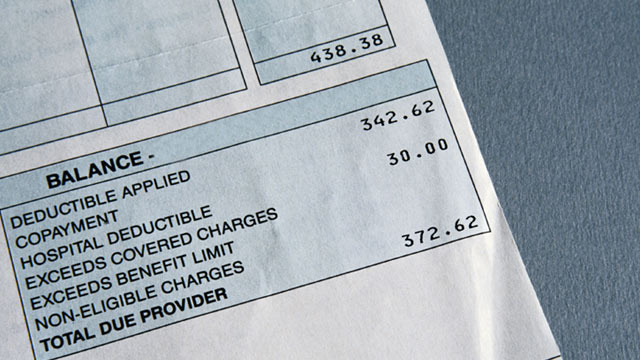

and ..., image source: s.abcnews.com

When to Pay a Higher Health Insurance Deductible - ABC News, image source: www.jctfinancial.com

Deduction Guides | JCT Financial, image source: boxinsurance.com

Understanding Insurance Deductibles, image source: www.insureyourcompany.com

taxes Archives | InsureYourCompany.com, image source: www.healthmarkets.com

Common Health Insurance Terms You Need to Know, image source: slideplayer.com

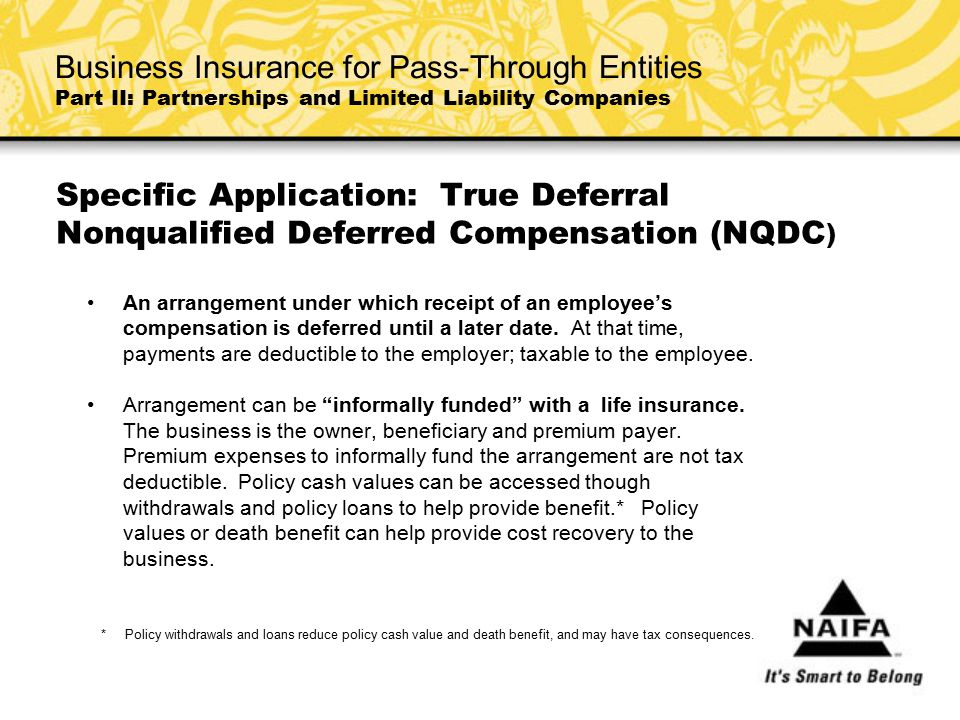

Business Insurance for Pass-Through Entities Part II ..., image source: fm.cnbc.com

Car insurance: Raising your deductible can mean big savings, image source: www.irmi.com

Property Insurance: Coinsurance | IRMI.com, image source: image.cdn.ispot.tv

Insurance Company: Nationwide Auto Insurance Commercial, image source: i1.wp.com

Irs Itemized Deduction Worksheet. Worksheets. Releaseboard ..., image source: 4.bp.blogspot.com

Democurmudgeon: Health Insurers continue to raise ..., image source: i.pinimg.com

Business Tax Deductions Worksheet | Random money tips and ..., image source: www.hiscox.com

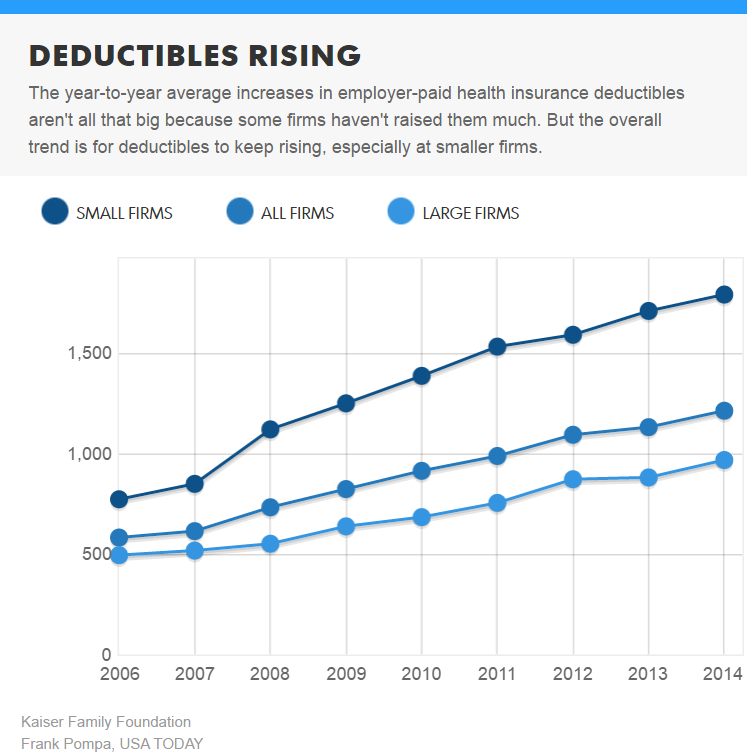

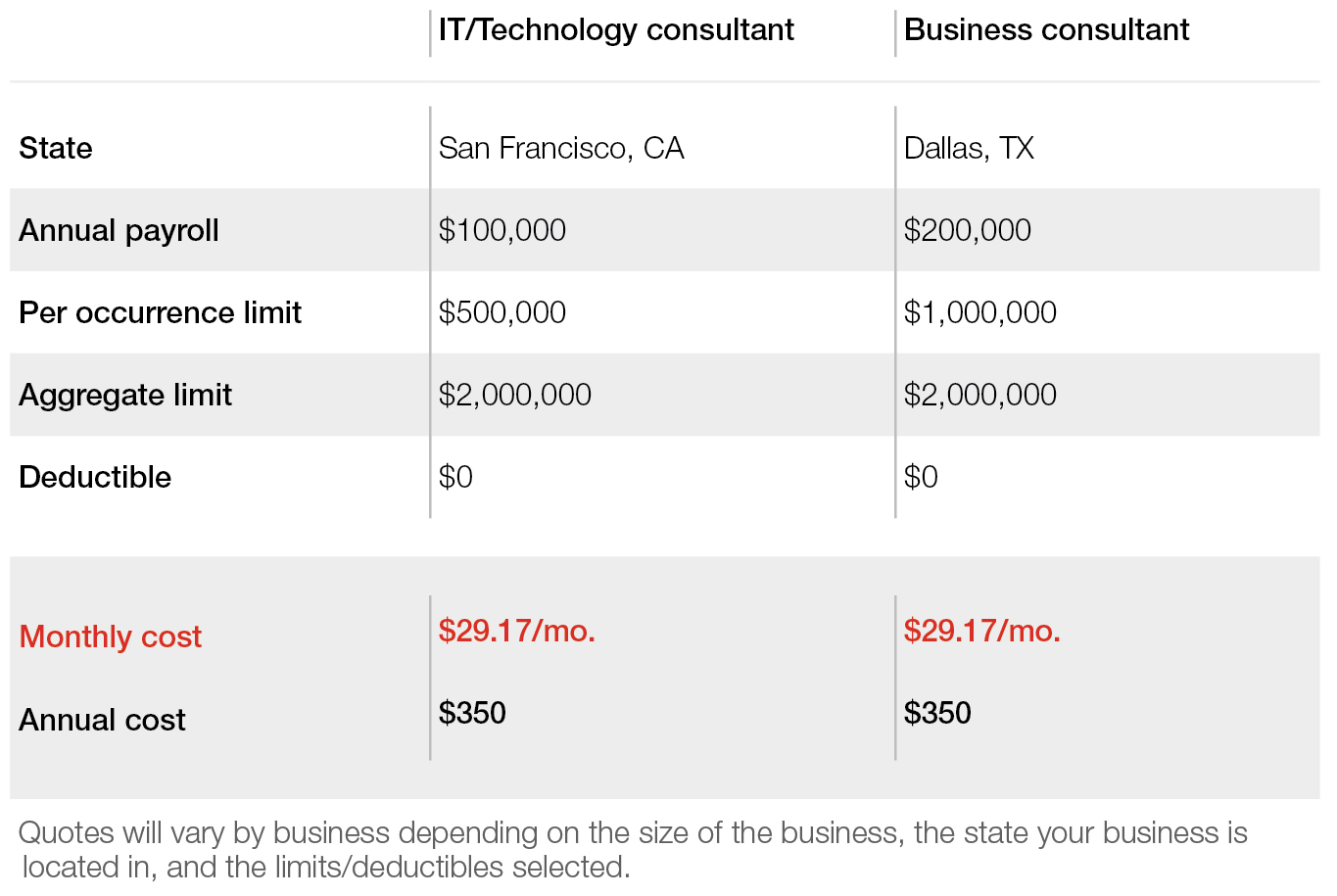

General Liability Insurance Cost | Hiscox, image source: i2.cdn.turner.com

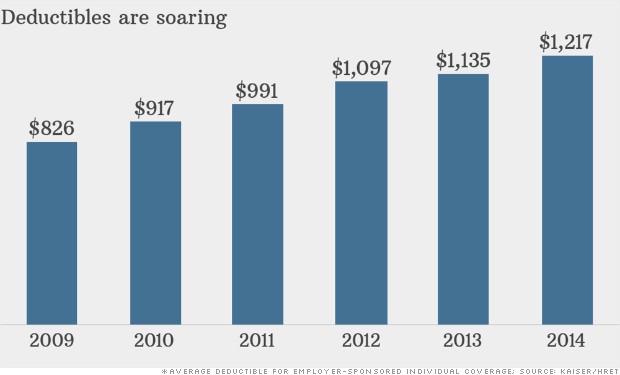

Paying thousands before health insurance even kicks in ..., image source: www.wikihow.com

4 Ways to Budget for a Health Insurance Deductible - wikiHow, image source: i.ytimg.com

How Does Section 179 Work | Autos Post, image source: www.davismiles.com

Income Tax Deductions Commonly Overlooked by Doctors (and ..., image source: atlantainsurance.com

How to choose a homeowners insurance deductible in Atlanta, image source: lisathetaxlady.files.wordpress.com

Tax Deductible Expenses – Lisa W. Hull, image source: slideplayer.com

CPA, image source: www.surepayroll.com

/about/GettyImages-200112809-001-5759eaf45f9b5892e8725db0.jpg)

PC, image source: fthmb.tqn.com

Business Insurance for Pass-Through Entities Part II ..., image source: cdn.app.compendium.com

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home