25 Images What Is A Deductible Amount

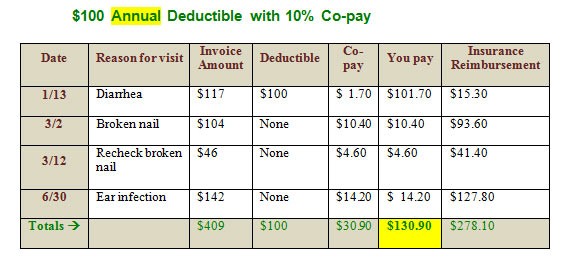

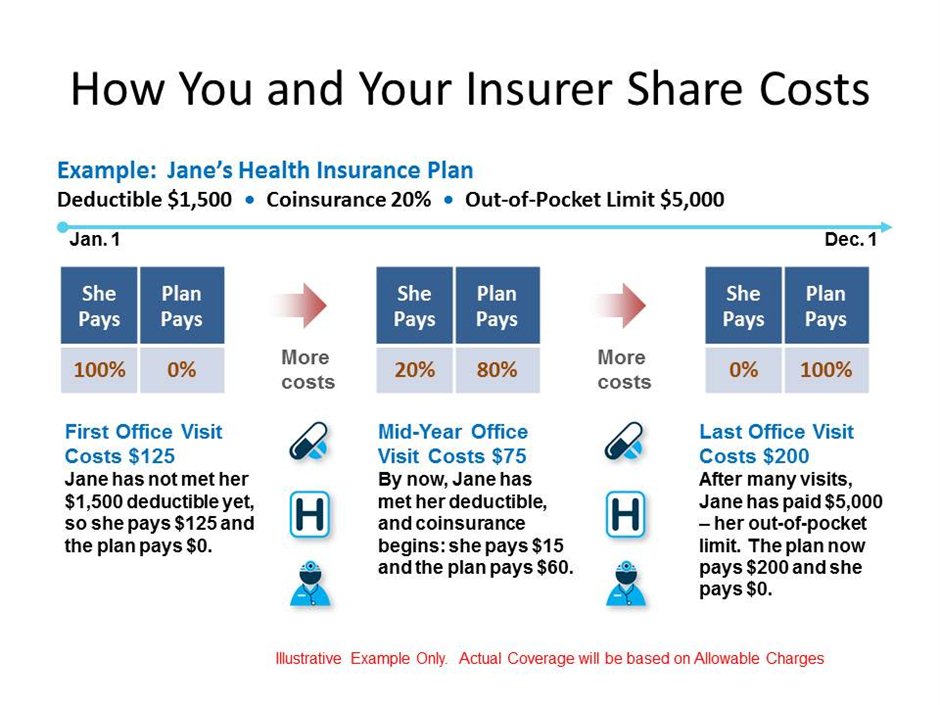

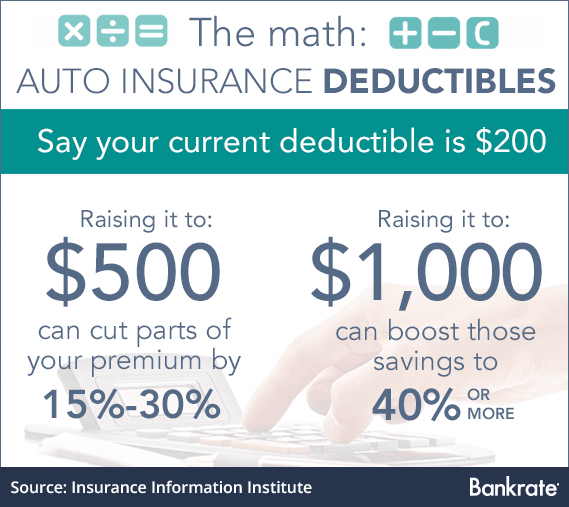

What Is A Deductible Amount taxes a deductible is the expenses subtracted from adjusted gross income for the determination of taxing liability What Is A Deductible Amount your insurance deductibleDeductible defined A deductible is an amount of money that you yourself are responsible for paying toward an insured loss When a disaster strikes your home or you have a car accident the amount of the deductible is subtracted or deducted from your claim payment

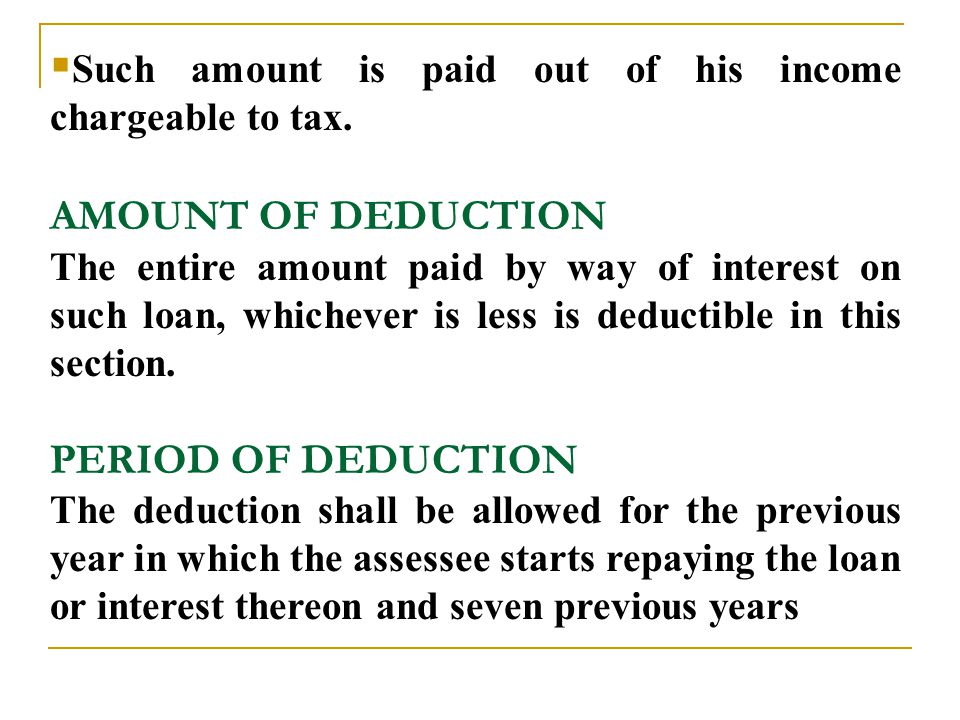

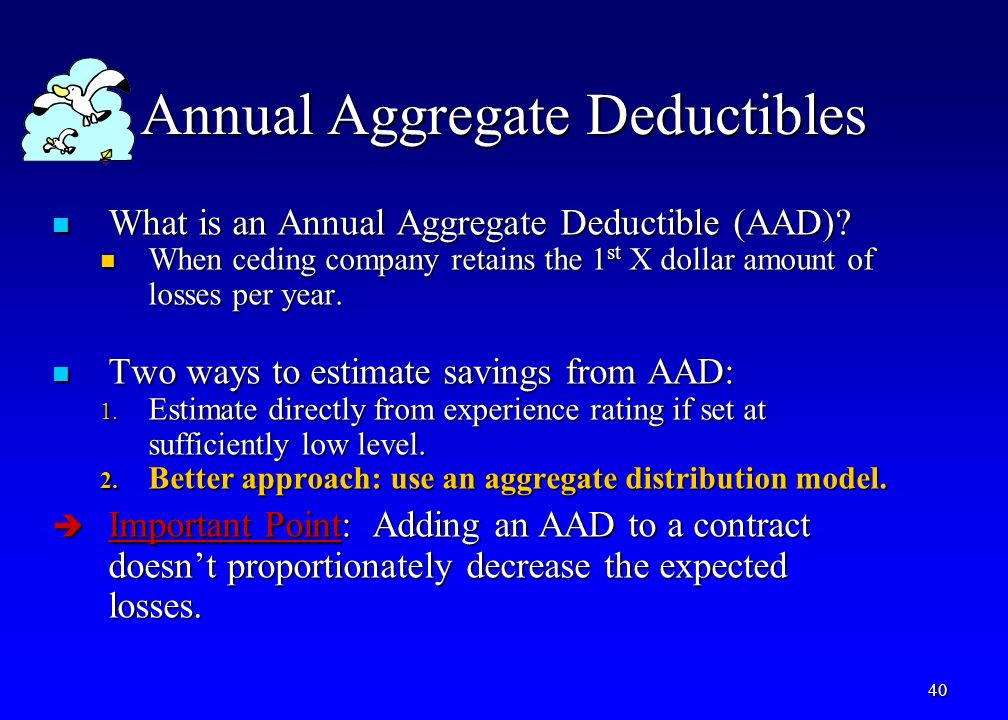

31 2018 Topic Number 504 Home Mortgage Points The term points is used to describe certain charges paid to obtain a home mortgage Points are prepaid interest and may be deductible as home mortgage interest if you itemize deductions on Form 1040 Schedule A pdf Itemized Deductions If you can deduct all of the interest on your mortgage you may be able to deduct all of the points paid on What Is A Deductible Amount insurance Home Renters InsuranceDollar amount percentage based and split homeowners insurance deductibles When it comes to home insurance there are three main types of deductible Savings Accounts HSAs A Health Savings Account HSA is a tax exempt trust or custodial account you set up with a qualified HSA trustee to pay or reimburse certain medical expenses you incur

deductible business expenses htmlTax deductible expenses are almost any ordinary necessary and reasonable expenses that help to earn business income Deductible expenses are those that can be subtracted from a What Is A Deductible Amount Savings Accounts HSAs A Health Savings Account HSA is a tax exempt trust or custodial account you set up with a qualified HSA trustee to pay or reimburse certain medical expenses you incur mvusdThis year s theme for the Moreno Valley College MVC contest is Passing the Baton to Keep the Pressure Alive Honoring the Legacy of Dr Martin Luther King Jr

What Is A Deductible Amount Gallery

DEDUCTIONS FROM GROSS TOTAL INCOME By: DR. N.K.GUPTA - ppt ..., image source: resources.ehealthinsurance.com

Health Care Decoded | The Daily Dose | CDPHP Blog, image source: slideplayer.com

Guide to Mental Health Co-Payments, image source: blog.cdphp.com

Co-Insurance, image source: therathink.com

and ..., image source: haveyouplanned.com

Understanding Your MediShield (Medical Insurance) Plans, image source: slns93t2j3c4h0o42gaac81d-wpengine.netdna-ssl.com

Coinsurance and Medical Claims, image source: image.slidesharecdn.com

Firefighters Most Overlooked Job Related Deductions, image source: kaiserfamilyfoundation.files.wordpress.com

What’s in Store for Medicare’s Part B Premiums and ..., image source: cdn.internationalinsurance.com

Deductibles, image source: blogs-images.forbes.com

Co-Pay and Out of Pocket Maximums, image source: slideplayer.com

Recent Announcements - Lindley'sTaxServices, image source: slideplayer.com

Accounting for Income Taxes - ppt video online download, image source: connect.bcbsok.com

March 11-12, image source: kaiserfamilyfoundation.files.wordpress.com

2004 Elliot Burn Wyndham Franklin Plaza Hotel ..., image source: slideplayer.com

Decoding Doctor’s Office Deductibles | Blue Cross Blue ..., image source: blogs-images.forbes.com

What’s in Store for Medicare’s Part B Premiums and ..., image source: kaiserfamilyfoundation.files.wordpress.com

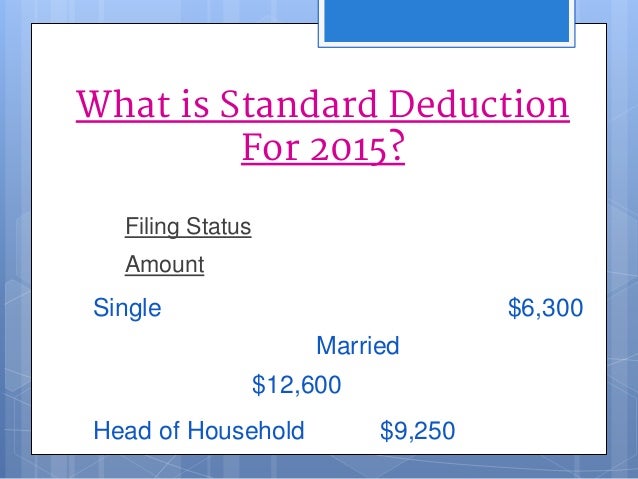

DEDUCTIONS FROM GROSS TOTAL INCOME By: DR. N.K.GUPTA - ppt ..., image source: www.worthtax.com

IRS Announces 2016 Tax Rates, image source: www.ustaxfs.com

Standard Deductions ..., image source: media.brstatic.com

EHBS 2015 – Section Eight: High-Deductible Health Plans ..., image source: kaiserfamilyfoundation.files.wordpress.com

Income Limitations for Itemized Deductions? | Taxes for ..., image source: insights.ibx.com

US Tax Changes for 2015 - US Tax & Financial Services, image source: sfmagazine.com

Choosing the Right Auto Insurance Deductible In 2 Easy ..., image source: www.texashealthoptions.com

What’s in Store for Medicare’s Part B Premiums and ..., image source: blog.cdphp.com

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home