25 Luxury Term Insurance Policy Definition

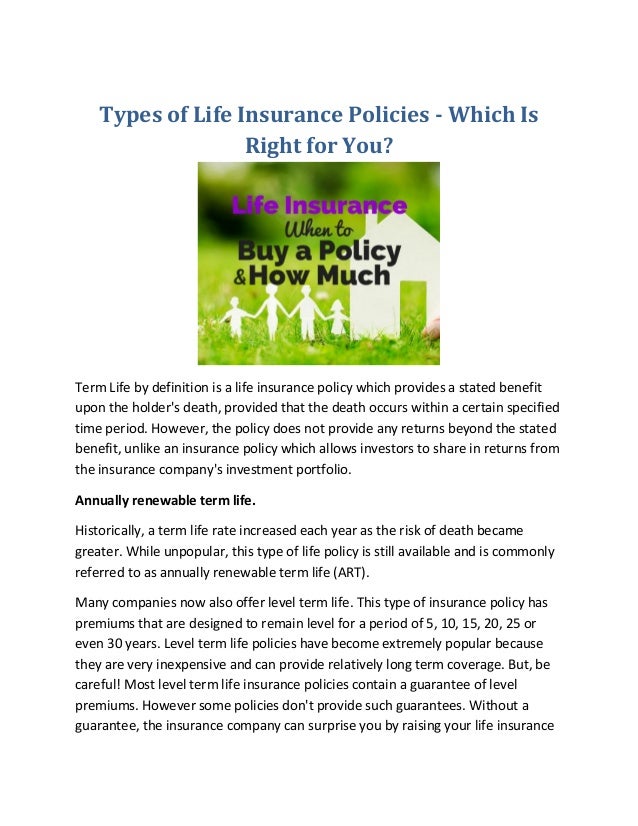

Term Insurance Policy life insurance or term assurance is life insurance that provides coverage at a fixed rate of payments for a limited period of time the relevant term After that period expires coverage at the previous rate of premiums is no longer guaranteed and the client must either forgo coverage or potentially obtain further coverage with different payments or conditions Term Insurance Policy acculifeinsurance whole term htmA recent study by the Life Insurance and Market Research Association reveals to us that nearly 56 of Americans do not have an individual life insurance policy and 30 have no life insurance coverage at

policytigerCompare Insurance Premiums with Policy Tiger and get insurance quotes for health insurance plans term life insurance plans car insurance Policies from the best Insurance companies in India Term Insurance Policy term life insurance quotes from the rates of over 100 life insurance companies free and unbiased TERM4SALE does not sell term life insurance it is owned by COMPULIFE Software Inc which sells life insurance comparison software to thousands ltcinsurancePurchasing Long Term Care Insurance is an exercise in understanding the type and amount of coverage you want and the associated cost It is imperative to know the basic elements such as your Daily Limit and if your policy has inflation coverage or not

termlife policybazaarTerm Life Insurance Term Life insurance provides coverage for a fixed period of time at a fixed premium rate In case of untimely death of the life insured during the policy term the nominee of the life insured gets the Total Payout Benefit Term Insurance Policy ltcinsurancePurchasing Long Term Care Insurance is an exercise in understanding the type and amount of coverage you want and the associated cost It is imperative to know the basic elements such as your Daily Limit and if your policy has inflation coverage or not accutermTerm Life A term life insurance policy is temporary insurance Like renting you are covered for the agreed upon time period which could be anything from 5 to 40 years Cheap term life insurance is often purchased because it is the least expensive of all types of policies

Term Insurance Policy Gallery

Buying Life Insurance When You Have Mitral Valve Prolapse, image source: 2.bp.blogspot.com

Term Insurance: Compare Best Online Term Plans in India ..., image source: www.jrcinsurancegroup.com

Metlife Insurance Quote | QUOTES OF THE DAY, image source: www.bankbazaar.com

Permanent Life Insurance 101: What You Need to Know | Allstate, image source: hdlifequotes.com

TYPES OF LIFE INSURANCE POLICIES IN INDIA, image source: www.allstate.com

Individual Life Insurance vs. Group Term Life Insurance - FBS, image source: image.slidesharecdn.com

Guranteed Issue Term Life Insurance, image source: fbsbenefits.com

10 Things You Need to Know in 2017 | No Medical Exam Life ..., image source: farm9.staticflickr.com

PolicyX - How to Choose a Term Plan, image source: myfinancialrevolution.com

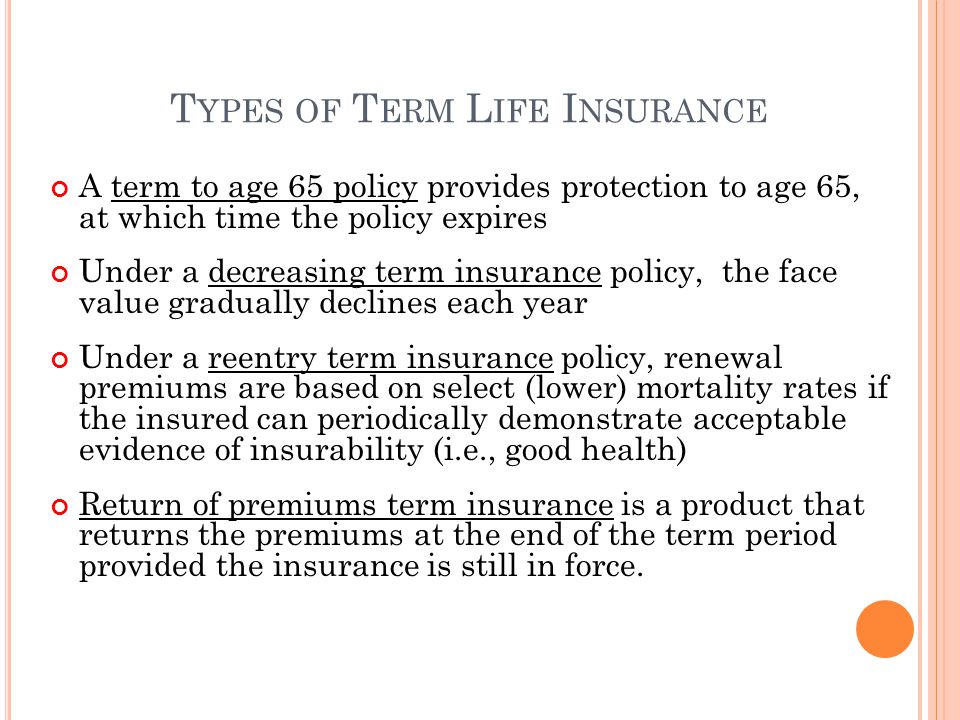

Chapter 16 Fundamentals of Life Insurance - ppt download, image source: www.policyx.com

Life Insurance, image source: slideplayer.com

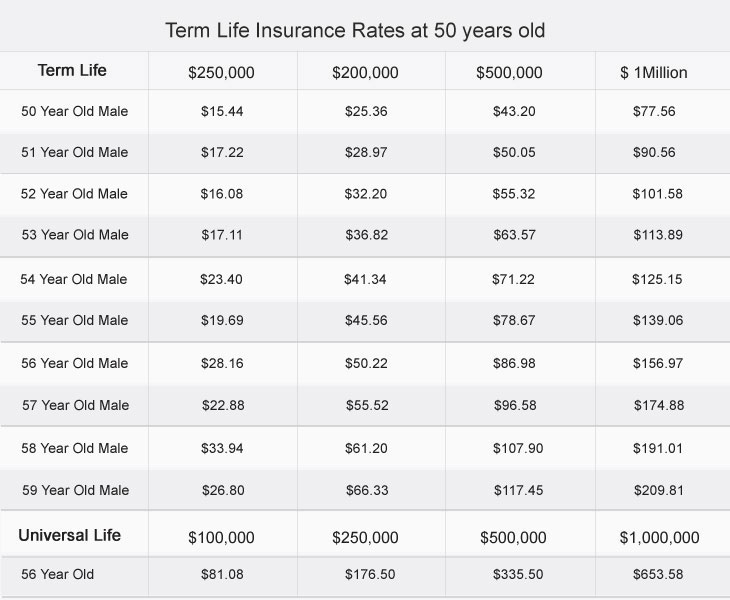

Plan the Future with Term Life Insurance at 56, image source: image.slidesharecdn.com

Mortgage Life Insurance vs. Term Life Insurance – Cost ..., image source: www.beyondquotes.com

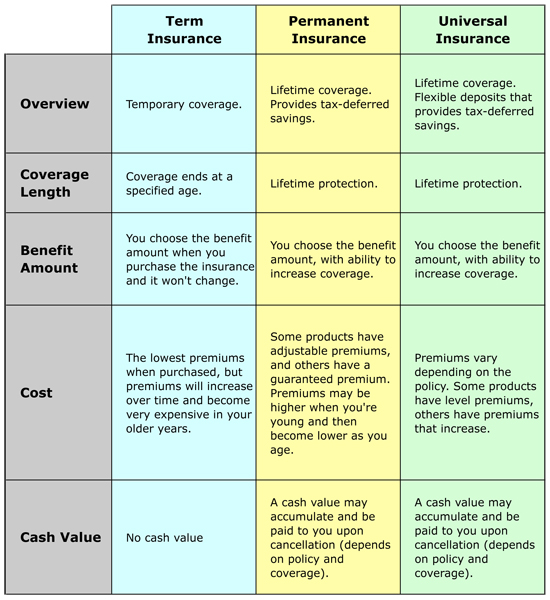

Types of Life Insurance – FB Financial & Associates, image source: www.jrcinsurancegroup.com

What's The Best Life Insurance Policy to Buy? It's Healthy ..., image source: fbfinancial.ca

Life insurance policy types of life insurance policies (1), image source: itshealthytobewealthy.com

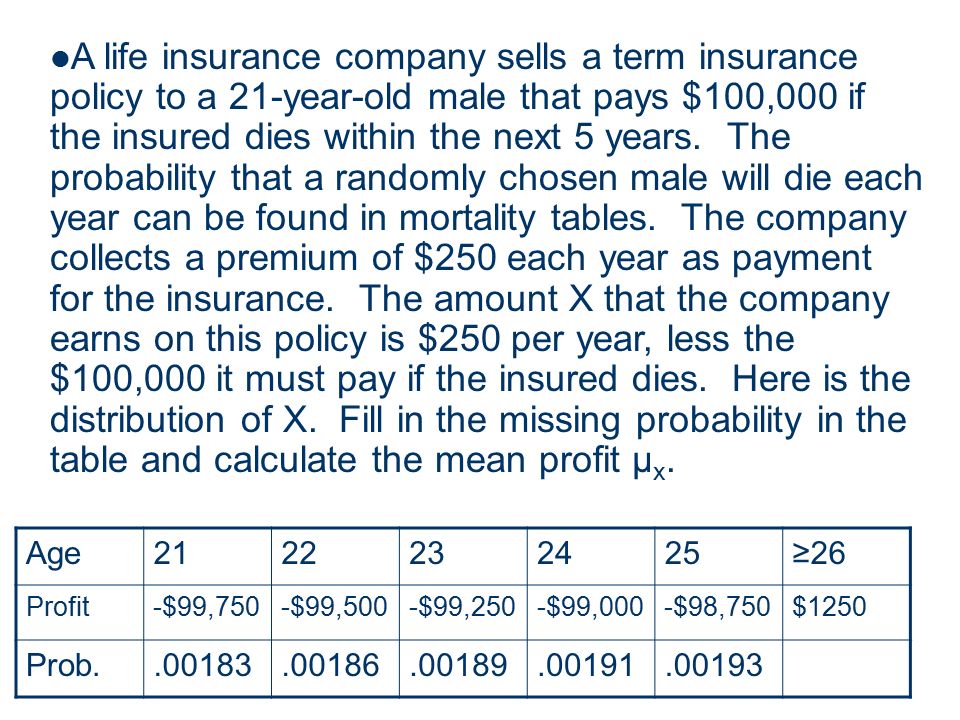

A life insurance company sells a term insurance policy to ..., image source: image.slidesharecdn.com

Term Insurance - Compare Online Term Plans & Policy, image source: slideplayer.com

Best Online Term Insurance Plans Comparison, image source: www.policybazaar.com

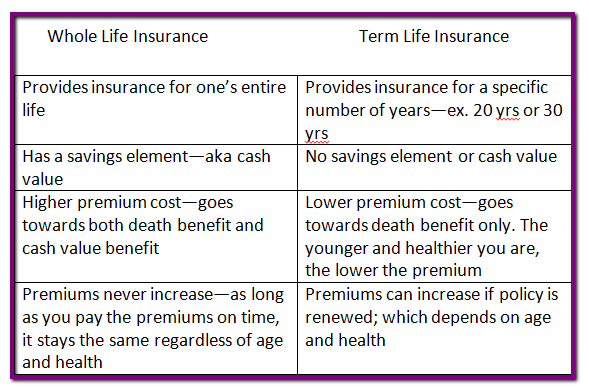

Should I buy Term or Whole Life Insurance? | TheFinance.sg, image source: www.simpleinterest.in

life Insurance -Intro, image source: thefinance.sg

Best Term Life Insurance Plans-Online Policy in India 2015 ..., image source: image.slidesharecdn.com

INSU 432 LIFE INSURANCE CHAPTER ppt download, image source: i1.wp.com

Term Life Insurance vs Whole and Universal Life Insurance ..., image source: slideplayer.com

1 Comments:

Thanks for sharing this post, very helpful and informative as well.

Purchasing the best term life insurance policy is a critical choice that must be done cautiously. It is a simple product wherein the policyholder gets life coverage against premiums paid for a fixed tenure. The coverage amount is paid to the beneficiaries by the insurance company if the applicant passes away within the policy tenure. The sum assured amount enable dependents of the insured to be financially stable while taking care of any liabilities left behind by the insurance holder.But if you are not cautious while investing in it, then your family might need to face budgetary hardships in your absence, regardless of your best efforts. That is the reason we have assembled a rundown of things you should remember while purchasing the best term insurance plan.

https://bimakaro.in/ik/term-life-insurance/points-to-remember-while-purchasing-best-term-life-insurance-550

Post a Comment

Subscribe to Post Comments [Atom]

<< Home