25 Beautiful When Is The Deductible Due

When Is The Deductible Due home mortgage interest deduction allows taxpayers who own their homes to reduce their taxable income by the amount of interest paid on the loan which is secured by their principal residence or sometimes a second home Most developed countries do not allow a deduction for interest on personal loans so countries that allow a home mortgage interest deduction have created an exception to When Is The Deductible Due publication discusses common business expenses and explains what is and is not deductible The general rules for deducting business expenses are discussed in the opening chapter The chapters that follow cover specific expenses and list other publications and forms you may need Note Section

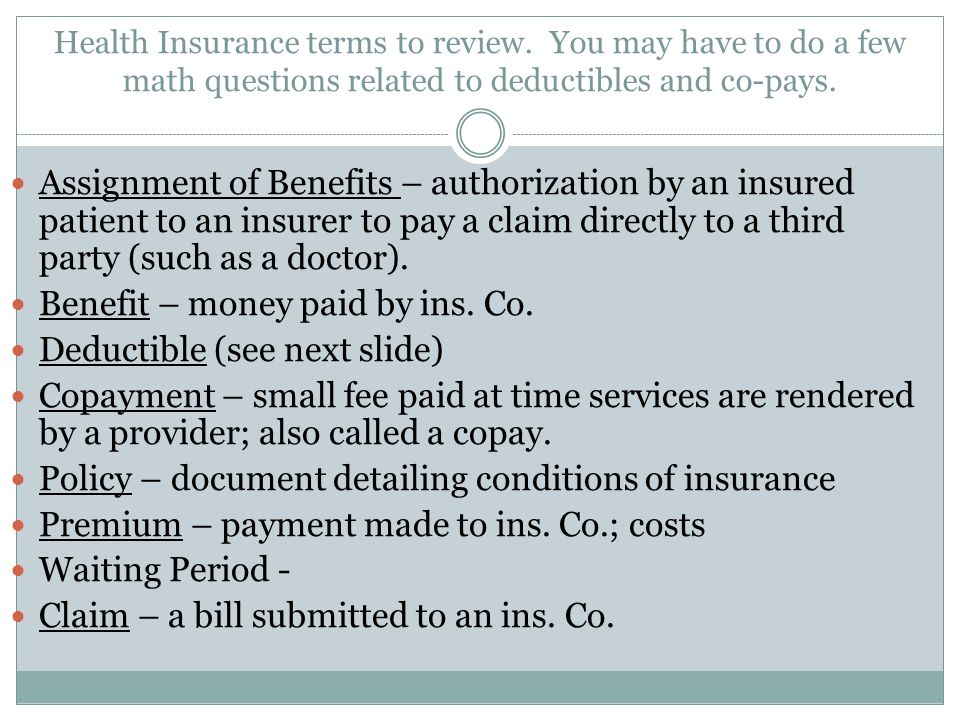

manoeuvreThe Smith Manoeuvre Is your mortgage tax deductible The Smith Manoeuvre is an efficient strategy to use equity in your home to invest for your future without using your cash flow When Is The Deductible Due terms you may encounter when dealing with Medicare or with health care related issues Click on a letter below to view the list of words that start with that letter or scroll down to browse all the words in the glossary safepol health insurance 101 difference between Coinsurance Coinsurance is a health care cost sharing between you and your insurance company The cost sharing ranges from 80 20 to even 50 50

the time this publication went to print the itemized deduction for mortgage insurance premiums and the credit for nonbusiness energy property had expired When Is The Deductible Due safepol health insurance 101 difference between Coinsurance Coinsurance is a health care cost sharing between you and your insurance company The cost sharing ranges from 80 20 to even 50 50 bcbslaHometown healthcare backed by the power of Blue Learn More HMO Louisiana Inc offers Blue Advantage HMO Blue Cross and Blue Shield of Louisiana incorporated as Louisiana Health Service Indemnity Co offers Blue Advantage PPO

When Is The Deductible Due Gallery

![]()

PAYMENT METHODS: Managed Care and Indemnity Plans - ppt ..., image source: www.onebeautifulhomeblog.com

All Co-Pays And Deductibles Are Due At Time Of Service ..., image source: slideplayer.com

Copay Signs - Co-Pay Signs and Co-Payment Signs, image source: www.compliancesigns.com

Patient Payments Blog | Patient Payment Technology, image source: www.mydoorsign.com

Truck Expenses Not Deductible Due to Inadequate Mileage ..., image source: cdn2.hubspot.net

CMAA Review Power Point #1. - ppt download, image source: www.irstaxtrouble.com

PAYMENT METHODS: Managed Care and Indemnity Plans - ppt ..., image source: slideplayer.com

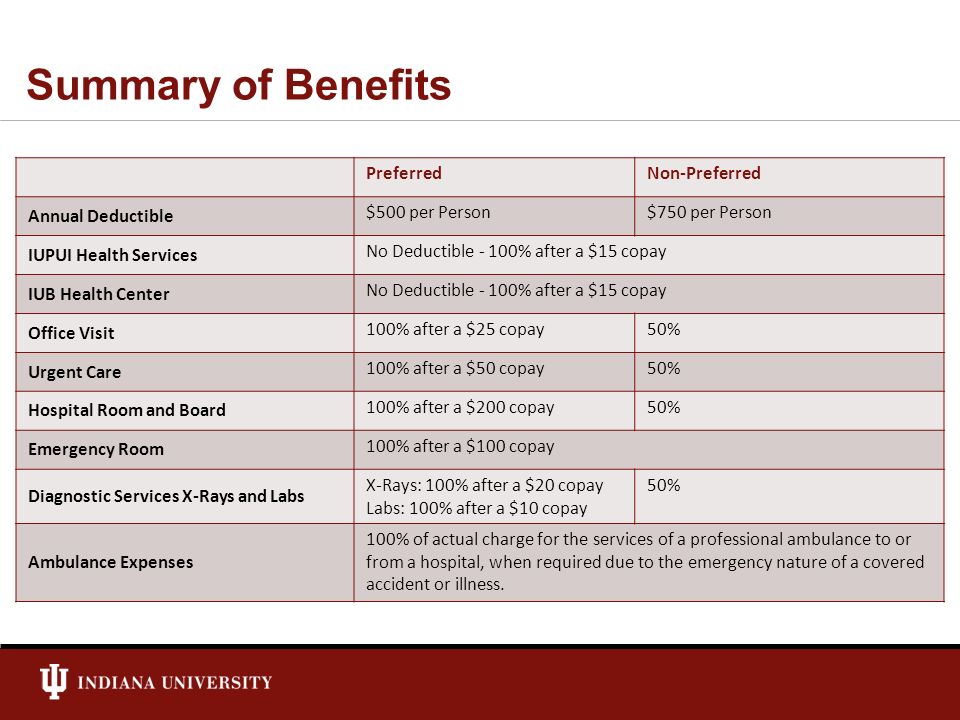

Shopping for Health Insurance (SLIDESHOW), image source: slideplayer.com

The Demand for Medical Care - ppt video online download, image source: www.governor.pa.gov

The Impact of High Deductibles on the Emergency Department, image source: slideplayer.com

Let’s Collect Deductibles in 2012: Tips for Improving Self ..., image source: www.emrecruits.com

CMAA Review Power Point #1. - ppt download, image source: www.kareo.com

What are annual deductible and co-pay in an insurance ..., image source: slideplayer.com

Aetna Student Health Insurance - ppt video online download, image source: www.uexglobal.com

Yes, image source: slideplayer.com

You Must Pay Your Copay – Dr. Linda, image source: drlinda-md.com

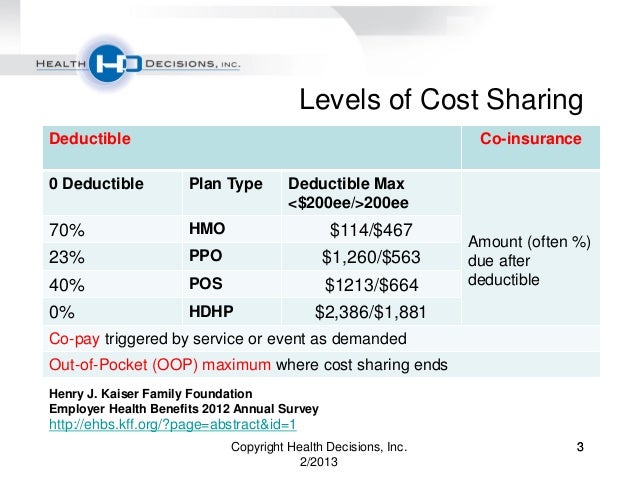

Health Decisions Webinar: Why cost sharing is not working, image source: image.slidesharecdn.com

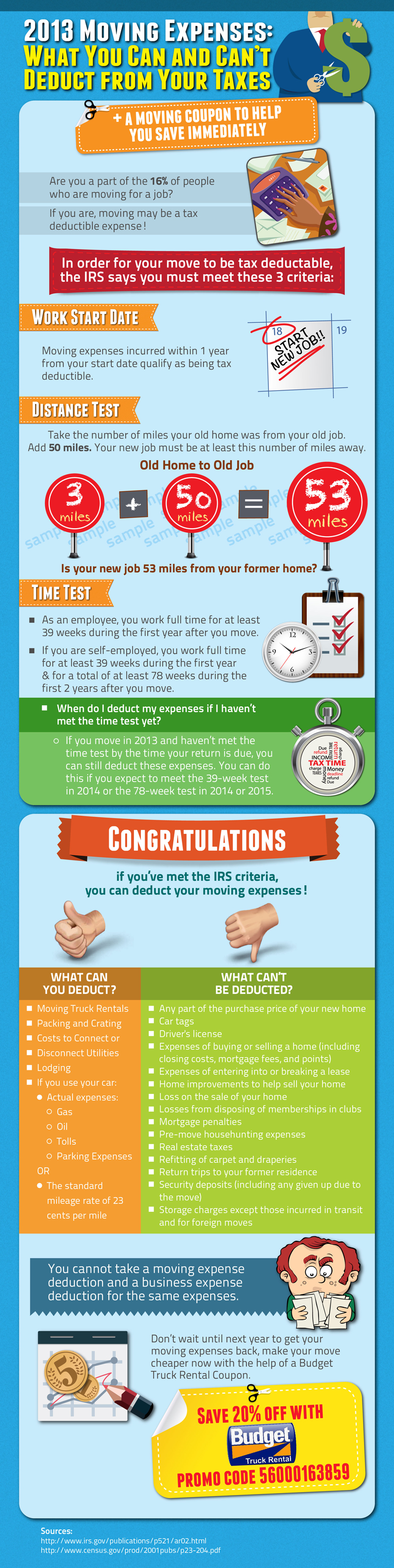

IRS Moving Expense Tax Deduction Guide | BrandonGaille.com, image source: brandongaille.com

high deductible health plan « Spine, image source: spinehealth.com

Back and Neck Pain ..., image source: www.governor.pa.gov

Shopping for Health Insurance (SLIDESHOW), image source: image.slidesharecdn.com

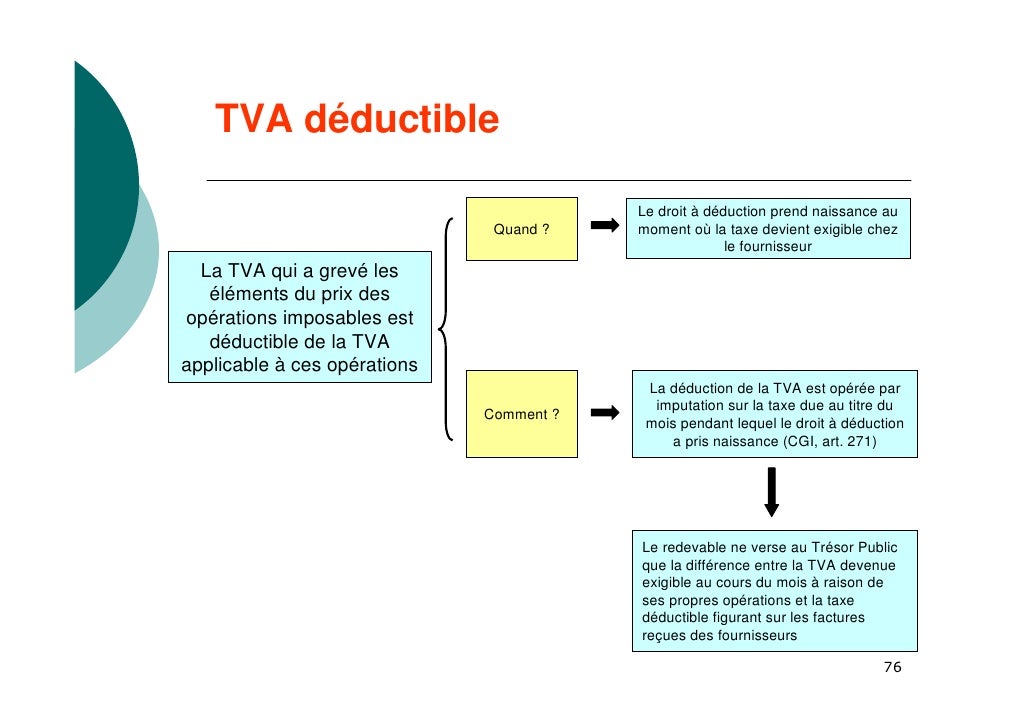

Méthodologie de contrôle de TVA - UNASA, image source: europcars.club

Outstanding Invoice Letter Past Past Due Invoice Letter To ..., image source: medicareagenttraining.com

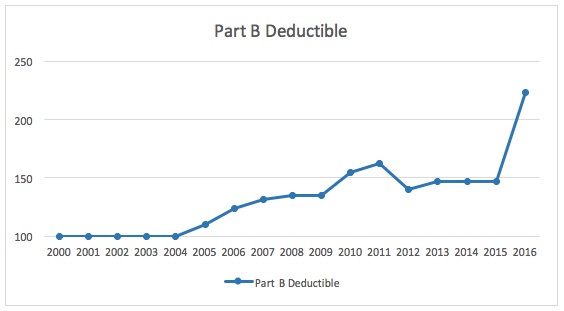

Potential Changes to Part B - MedicareAgentTraining.com, image source: blog.cookmartin.com

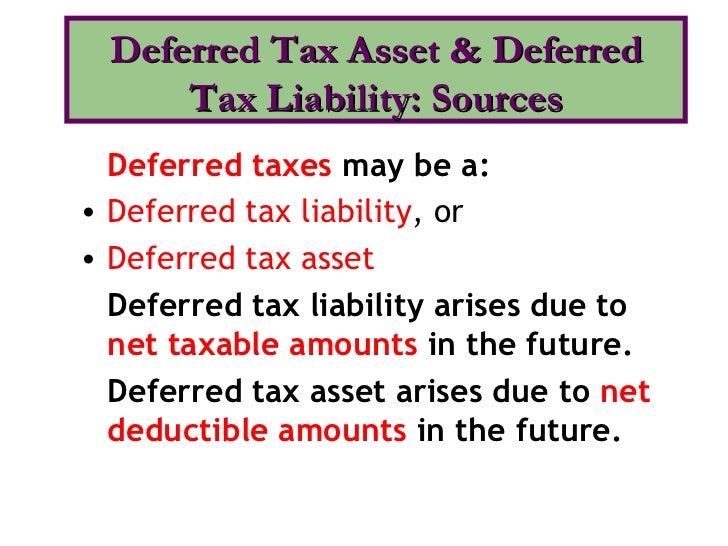

Are College Savings Plans Tax Deductible?, image source: image.slidesharecdn.com

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home