25 Images Deductible Amount

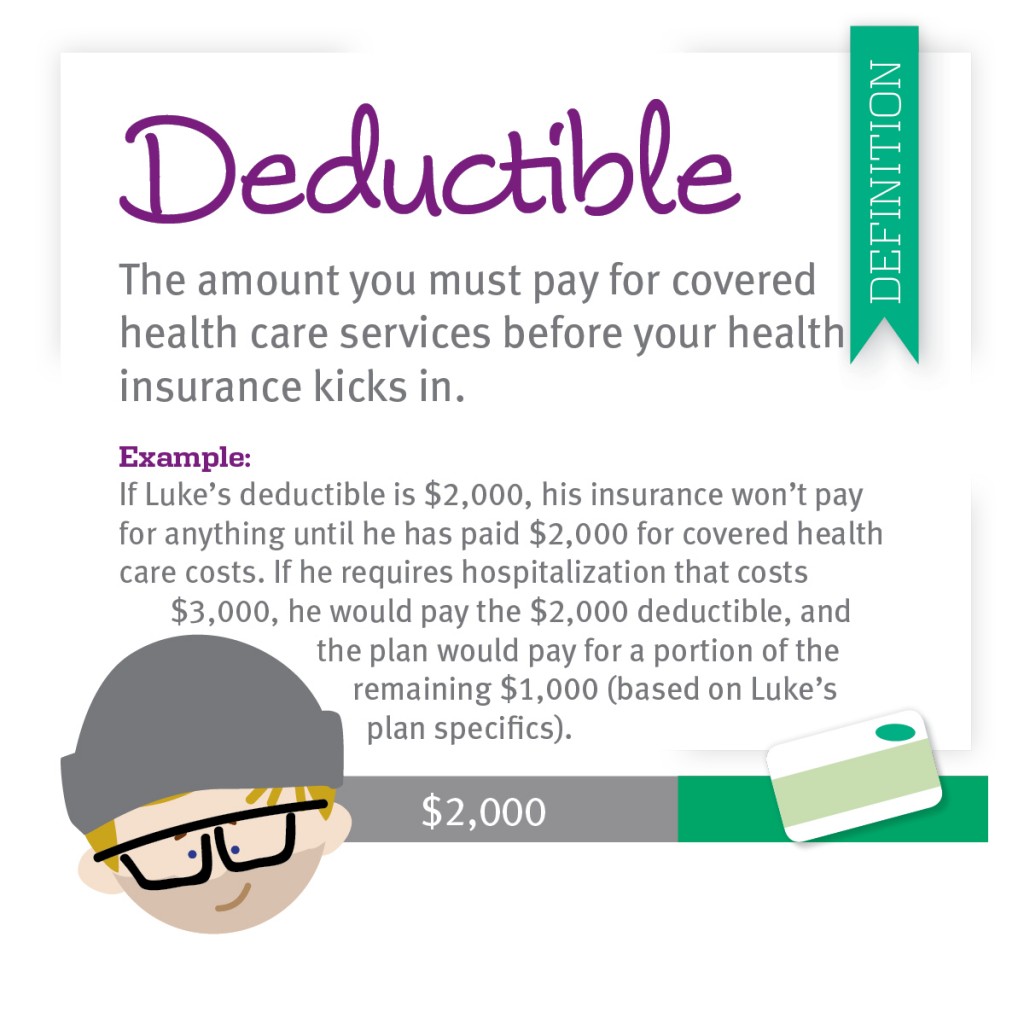

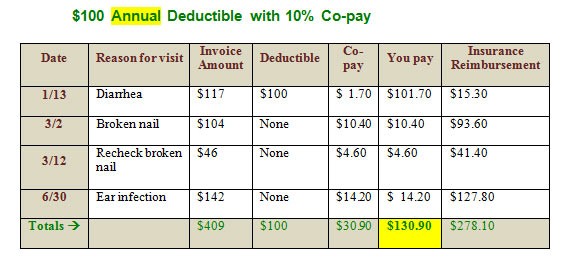

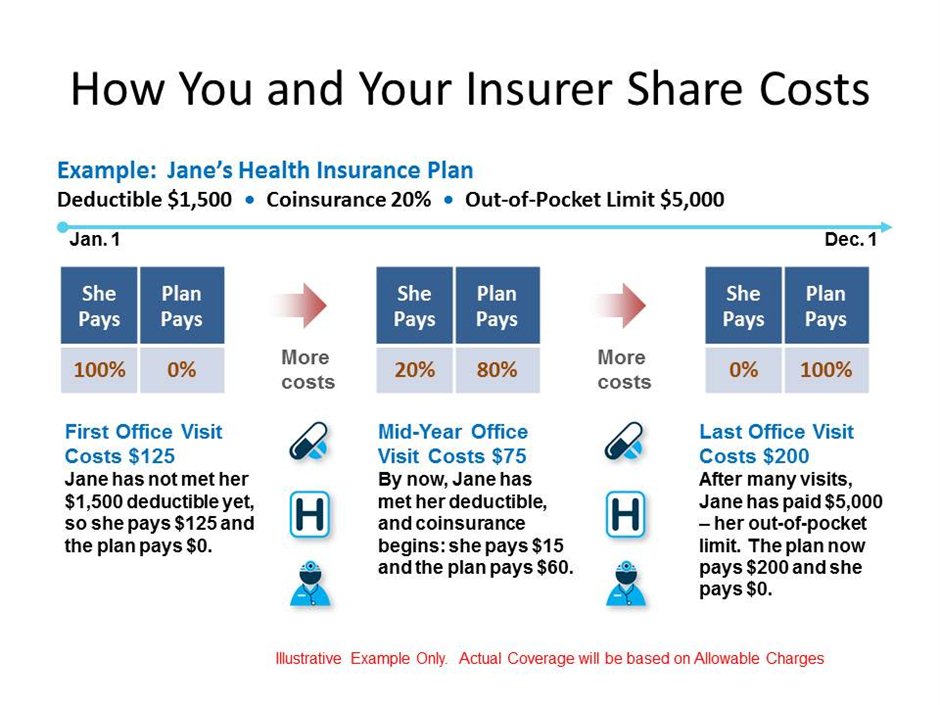

Deductible Amount Deductible Amount amount you pay for covered health care services before your insurance plan starts to pay With a 2 000 deductible for example you pay the first 2 000 of covered services yourself After you pay your deductible you usually pay only a copayment or coinsurance for covered services Your insurance company pays the rest

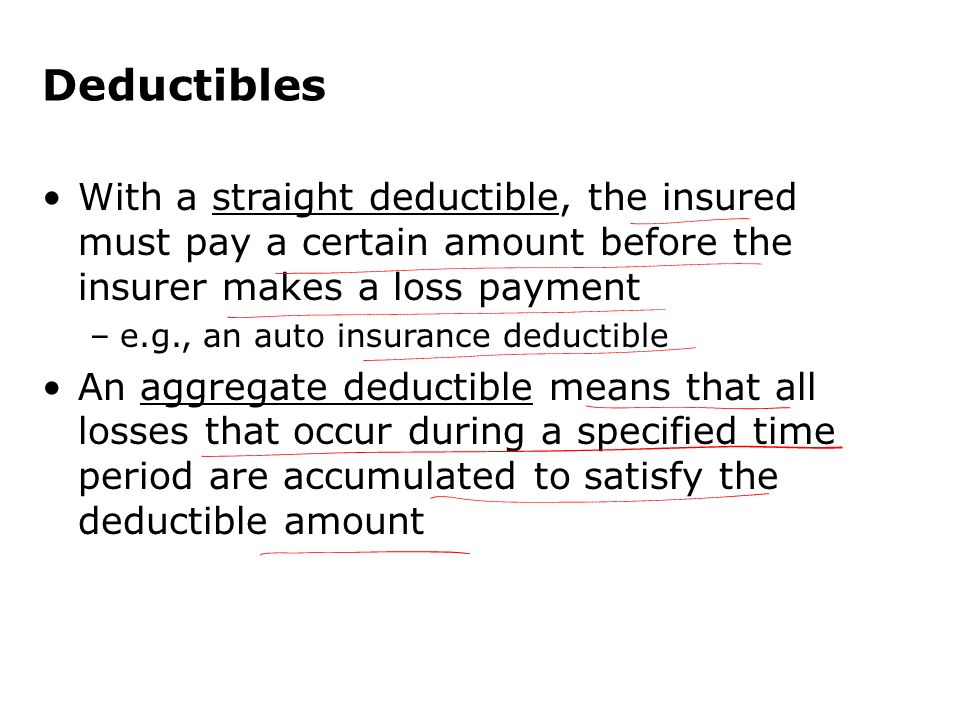

deductible 2645763The insurance deductible is the amount of money you will pay in an insurance claim before the insurance coverage kicks in and the company starts paying you When you have a deductible you have to come up with the amount of money for your deductible before a claim gets paid in many circumstances Deductible Amount meeting the annual deductible amount the insurer covers the full costs for the rest of the year Exceptions such as co payments and co insurance may apply progressive AnswersWhat is a car insurance deductible References to average or typical premiums amounts of losses deductibles costs of coverages repair etc are illustrative and may not apply to your situation We are not responsible for the content of any third party sites linked from this page

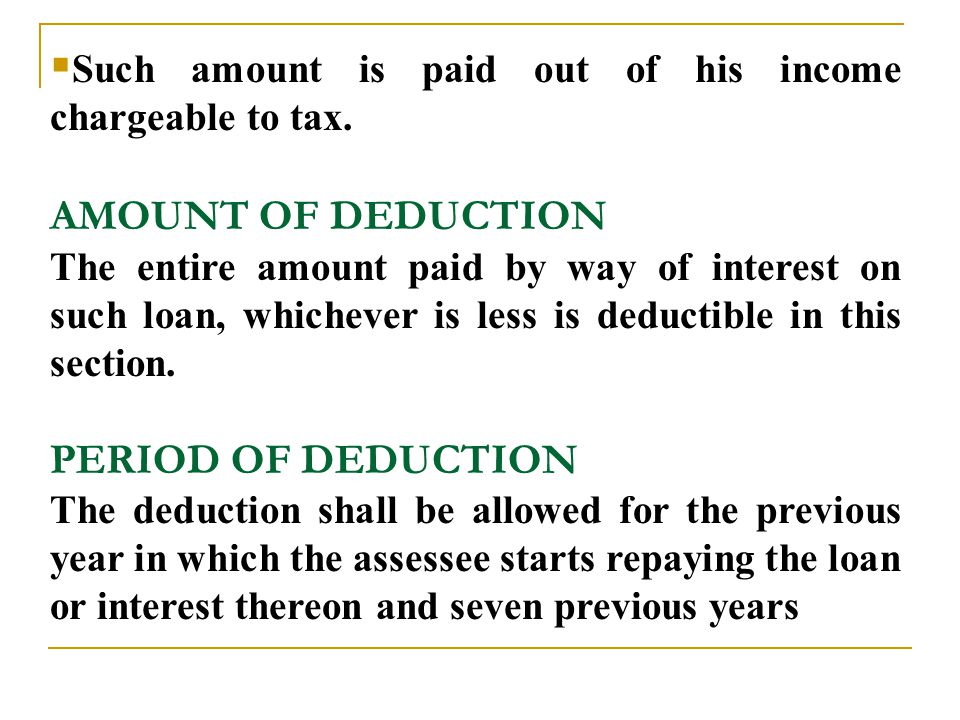

amountThe deductible amount the employee premium contribution the out of pocket maximum and whether there are other types of plans offered will also impact an employer s HSA contribution strategy said Mark Sherman principal of LHD Benefit Advisors another UBA partner firm Deductible Amount progressive AnswersWhat is a car insurance deductible References to average or typical premiums amounts of losses deductibles costs of coverages repair etc are illustrative and may not apply to your situation We are not responsible for the content of any third party sites linked from this page superguy au centrelink deductible amount formulaThe Centrelink Deductible Amount formula is based on the purchase price of your income stream and life expectancy at commencement of the income stream as detailed in the article above and take into account gross payments received less the deductible amount

Deductible Amount Gallery

Health Care Decoded | The Daily Dose | CDPHP Blog, image source: resources.ehealthinsurance.com

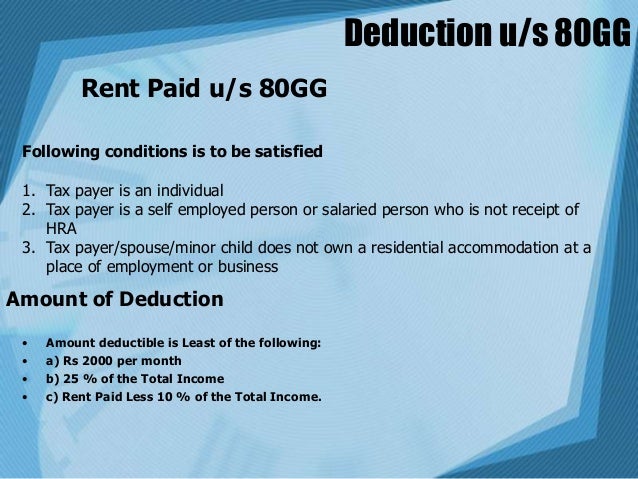

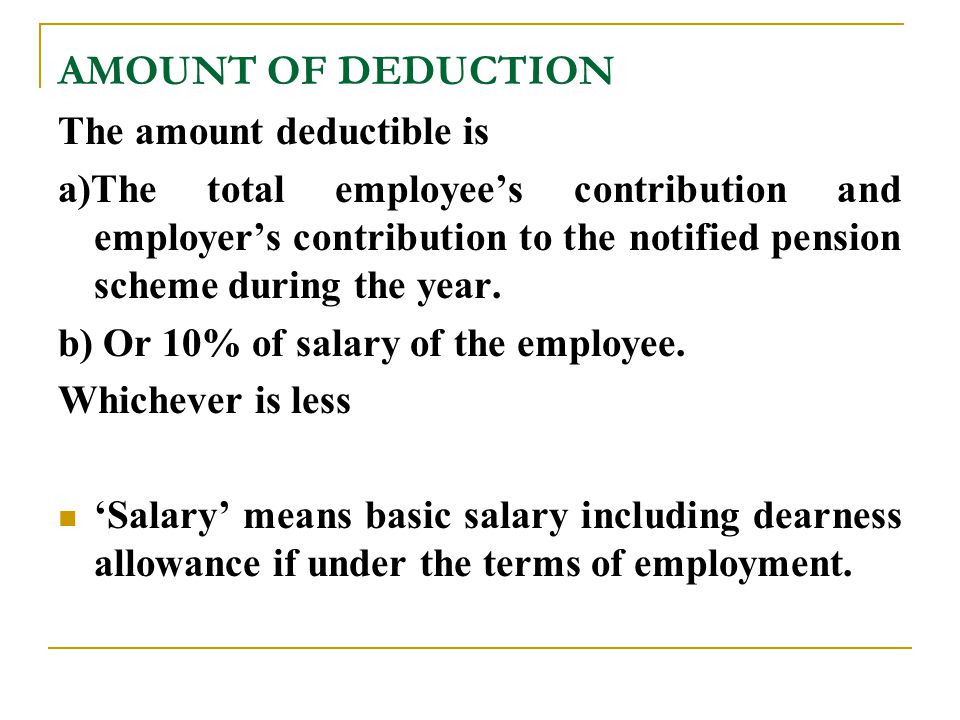

DEDUCTIONS FROM GROSS TOTAL INCOME By: DR. N.K.GUPTA - ppt ..., image source: blog.cdphp.com

FlexiHealth Insurance | my Insurance Partner, image source: slideplayer.com

Understanding Your MediShield (Medical Insurance) Plans, image source: opulenceconsultancy.files.wordpress.com

PAYMENT METHODS: Managed Care and Indemnity Plans - ppt ..., image source: haveyouplanned.com

What’s in Store for Medicare’s Part B Premiums and ..., image source: slideplayer.com

Accounting for Income Taxes - ppt video online download, image source: kaiserfamilyfoundation.files.wordpress.com

Analysis of Insurance Contracts - ppt video online download, image source: slideplayer.com

Recent Announcements - Lindley'sTaxServices, image source: slideplayer.com

Guide to Mental Health Co-Payments, image source: blogs-images.forbes.com

Co-Insurance, image source: therathink.com

and ..., image source: kaiserfamilyfoundation.files.wordpress.com

What’s in Store for Medicare’s Part B Premiums and ..., image source: kaiserfamilyfoundation.files.wordpress.com

What’s in Store for Medicare’s Part B Premiums and ..., image source: 1.bp.blogspot.com

Insurance Made Easy: Deductibles and Coverage limits in ..., image source: image.slidesharecdn.com

Deductions from gross total income, image source: slideplayer.com

DEDUCTIONS FROM GROSS TOTAL INCOME By: DR. N.K.GUPTA - ppt ..., image source: blogs-images.forbes.com

2016 Tax Rates, image source: slideplayer.com

Brackets & Exemption Amounts May Result In ..., image source: connect.bcbsok.com

Consumer-Driven Health Care: Medtronic’s Health Insurance ..., image source: slideplayer.com

Decoding Doctor’s Office Deductibles | Blue Cross Blue ..., image source: www.autoinsuresavings.org

Learning Objectives Identify and examine the health ..., image source: kaiserfamilyfoundation.files.wordpress.com

Choosing Auto Insurance Plan? 4 Things to Consider Before ..., image source: slideplayer.com

EHBS 2015 – Section Eight: High-Deductible Health Plans ..., image source: www.taxpolicycenter.org

Employee Expenses and Deferred Compensation - ppt download, image source: fm.cnbc.com

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home