25 Awesome Health Care Annual Deductible

Health Care Annual Deductible ncsl research health hsas health savings accounts aspxHealth Savings Accounts HSAs and High Deductible Health Plans HDHPs have spread in the past 15 years with new laws and evolving practices in virtually all 50 states NCSL s report adds 2015 2017 requirements that fit health exchanges or marketplace health plans Health Care Annual Deductible Savings Accounts HSAs A Health Savings Account HSA is a tax exempt trust or custodial account you set up with a qualified HSA trustee to pay or reimburse certain medical expenses you incur

health savings account HSA is a tax advantaged medical savings account available to taxpayers in the United States who are enrolled in a high deductible health plan HDHP The funds contributed to an account are not subject to federal income tax at the time of deposit Unlike a flexible spending account FSA HSA funds roll over and accumulate year to year if they are not spent HSAs are Health Care Annual Deductible Care Organization ACO A group of doctors who work together to manage patient care Health care reform law offers incentives for doctors to form Medicare ACOs starting in 2012 Health outreach staff help spread the word about free and low cost health insurance

This publication explains the itemized deduction for medical and dental expenses that you claim on Schedule A Form 1040 It discusses what expenses and whose expenses you can and can t include in figuring the deduction Health Care Annual Deductible Health outreach staff help spread the word about free and low cost health insurance deductible health care plans 2848181Sep 24 2013 If you re looking to cut your health care insurance premium one route is a high deductible insurance plan But the downside is this If you

Health Care Annual Deductible Gallery

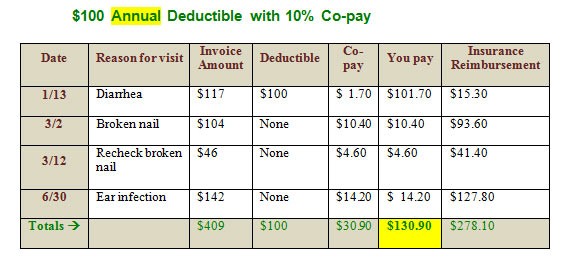

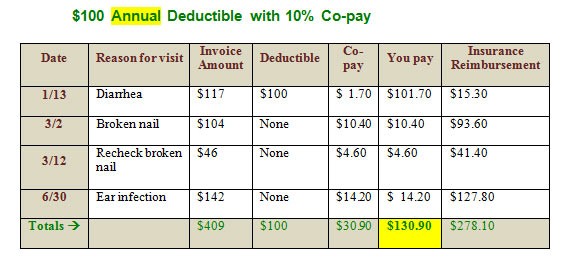

Co-Insurance, image source: therathink.com

and ..., image source: assocagencies.com

Annual Deductible Limit Repealed for Small Health Plans ..., image source: bestinsurancereviews.org

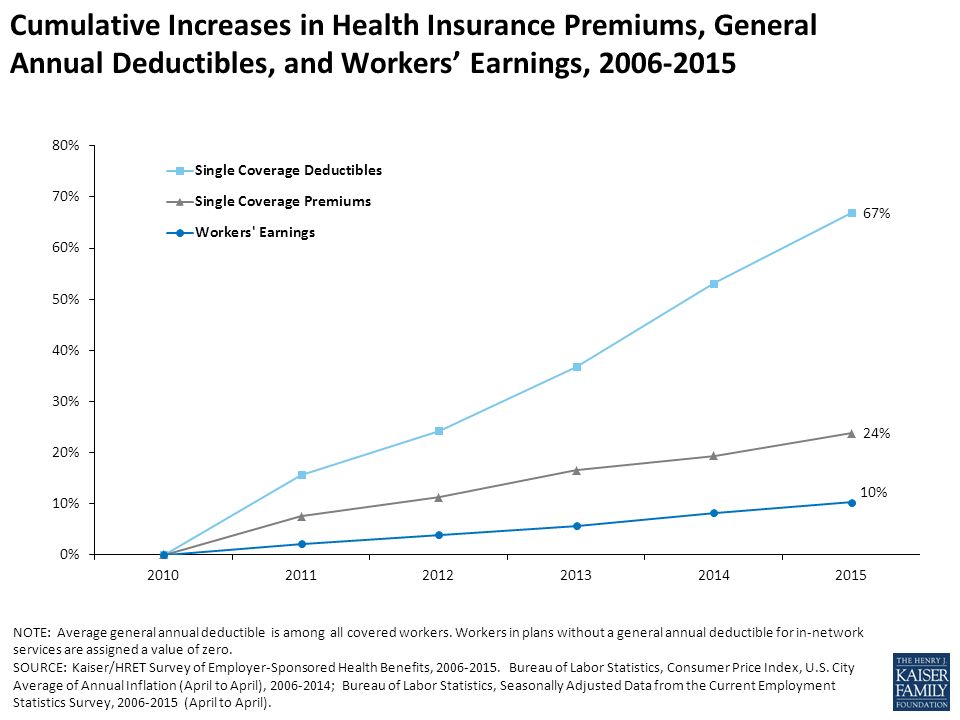

What is Catastrophic Health Insurance?, image source: kaiserfamilyfoundation.files.wordpress.com

Snapshots: The Prevalence and Cost of Deductibles in ..., image source: 3.bp.blogspot.com

Health Insurance for Under $50 per Month?, image source: kaiserfamilyfoundation.files.wordpress.com

Snapshots: The Prevalence and Cost of Deductibles in ..., image source: kaiserfamilyfoundation.files.wordpress.com

A Comparison of the Availability and Cost of Coverage for ..., image source: kaiserfamilyfoundation.files.wordpress.com

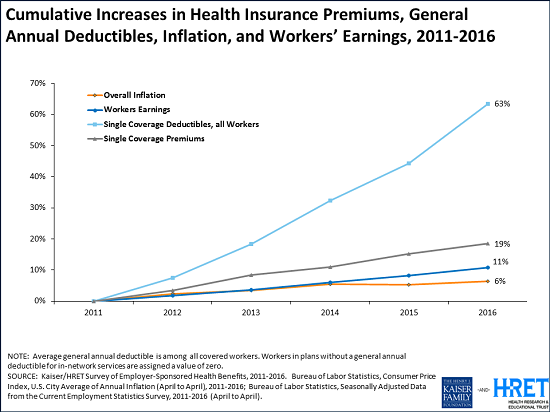

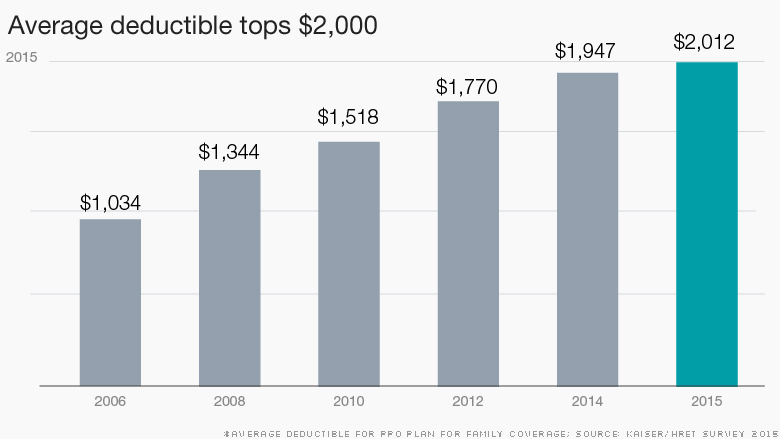

EHBS 2015 – Summary Of Findings – 8775 | The Henry J ..., image source: kaiserfamilyfoundation.files.wordpress.com

Snapshots: Premiums, image source: slideplayer.com

Cost-Sharing and Coverage at Public ..., image source: cdn2.hubspot.net

Average Annual Premium Increases for Family Coverage ..., image source: i2.cdn.turner.com

Average Annual Workplace Family Health Premiums Rise ..., image source: kaiserfamilyfoundation.files.wordpress.com

5 ways your health insurance will cost more, image source: kaiserfamilyfoundation.files.wordpress.com

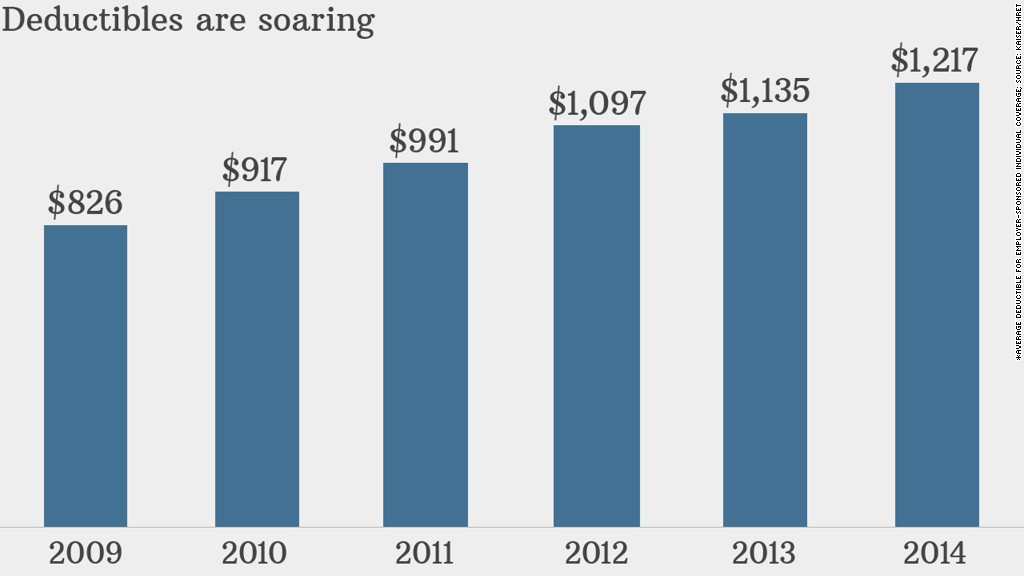

Snapshots: The Prevalence and Cost of Deductibles in ..., image source: 3.bp.blogspot.com

Medical Debt Among Insured Consumers: The Role of Cost ..., image source: kaiserfamilyfoundation.files.wordpress.com

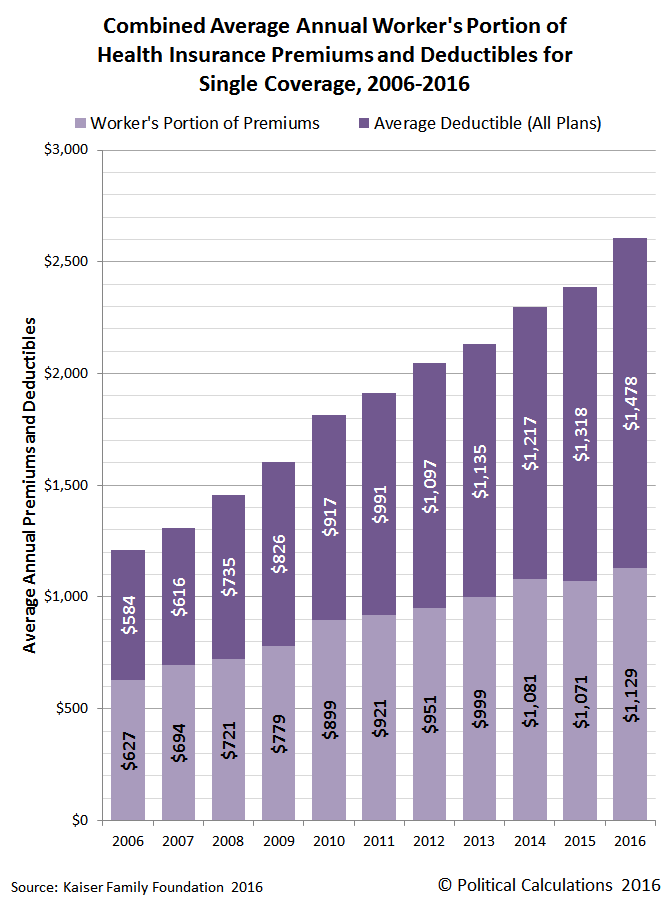

Political Calculations: The Trends for Health Insurance ..., image source: upload.wikimedia.org

EHBS 2016 – Summary Of Findings – 8905 | The Henry J ..., image source: www.uexglobal.com

Insurance experts: prepare for substantial ACA/deductible ..., image source: mibiz.com

What are annual deductible and co-pay in an insurance ..., image source: www.mymoneyblog.com

Report: Majority of companies offer high-deductible health ..., image source: 2.bp.blogspot.com

Health Insurance Premiums: Average Annual Cost $19, image source: sc.cnbcfm.com

000 ..., image source: i2.cdn.turner.com

Progressive Roots: The unsustainable costs of American ..., image source: austinbenefits.com

Health care premiums grow at lowest rate decade: Analysis, image source: slideplayer.com

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home